Early on, while every internet company was trying to get you to and keep you on its website, Google was busy sending you away happy. People would go to Google to search, find what they were looking for and then leave. It was a genius and counterintuitive move.

With the public launch of Gmail in 2007, that strategy started shifting as $GOOG began keeping users on its site for longer and longer periods as they managed their email. Next came a whole host of other services including Drive and Google Plus, which are also more traditional in that they are also intended to engage and keep users on site.

Google has also shifted the way in which search influences user behavior. When once it was all about helping you find the external web page you were looking for, now it is more about giving you what you were looking for directly.

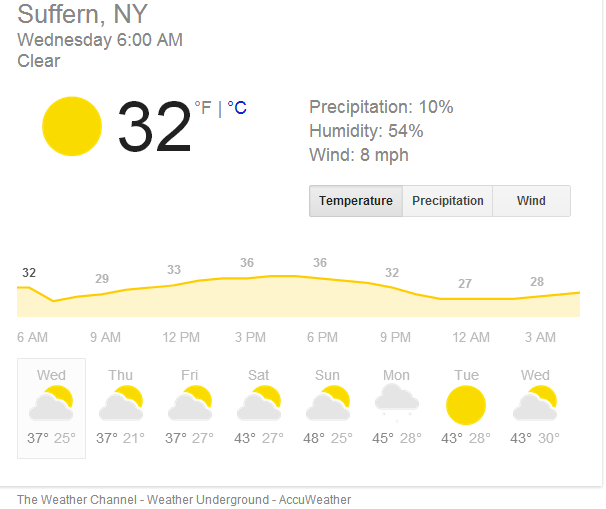

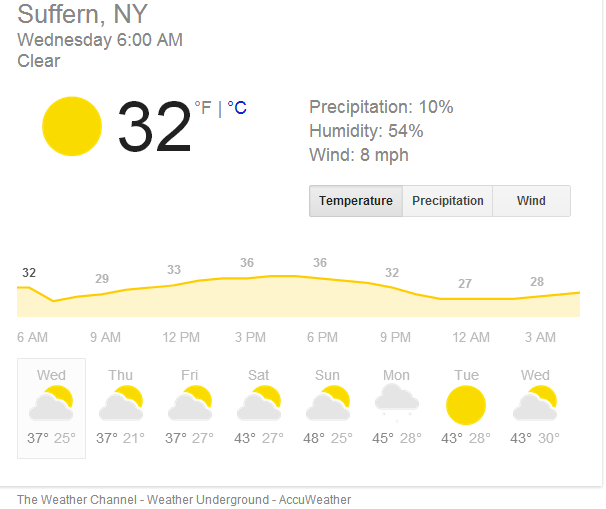

Take, for example the weather. This is what I get at the top when I search Google for weather 10901:

Beautiful. This is simple and all I wanted. So, instead of giving me the best weather sites, it just gives me the information I wanted. I no longer need to go anywhere else.

Sorry, weather.com.

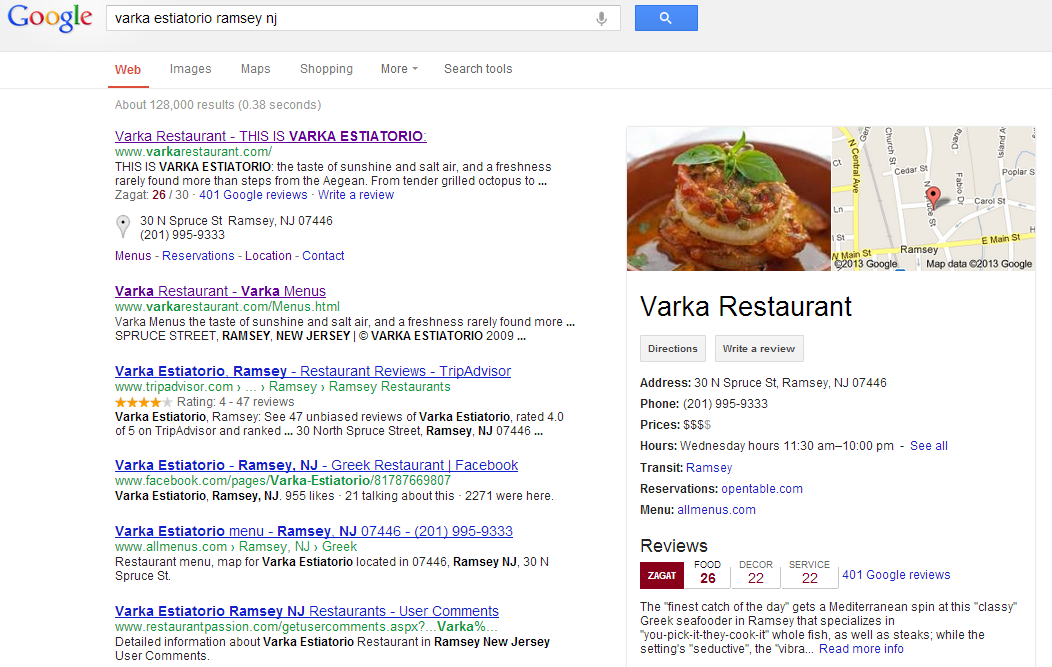

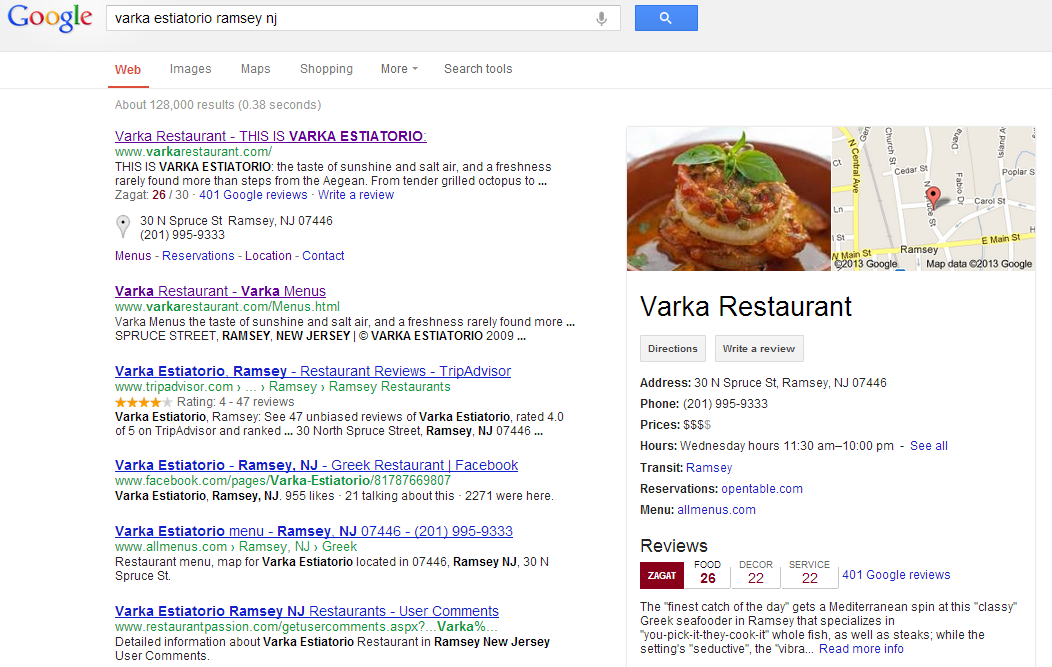

Its not only the weather. Here’s what I get when I search for the wonderful varka estiatorio ramsey nj:

Nice little Zagat integration, sure, but also note the 401 reviews. Not only that, but when you click Read more info you go to Varka’s Google+ page. That little hyperlink is super important for a couple of reasons. First, it motivates restaurants to get on G+, make their page look nice and keep it up to date.

They will also be rewarded for doing this in search results (believe it). Second, its a shift from the way $YELP handles the restaurant as it gives more control to the restaurants who can now fill the page with great photos, specials, whatever they like in order to make it appealing users.

Sorry Yelp.

Not only is Google disrupting $YELP here with minimal effort and lower costs, but they are setting the stage for every business to need to set up and update its Google+ page.

Google is also disrupting content farms.

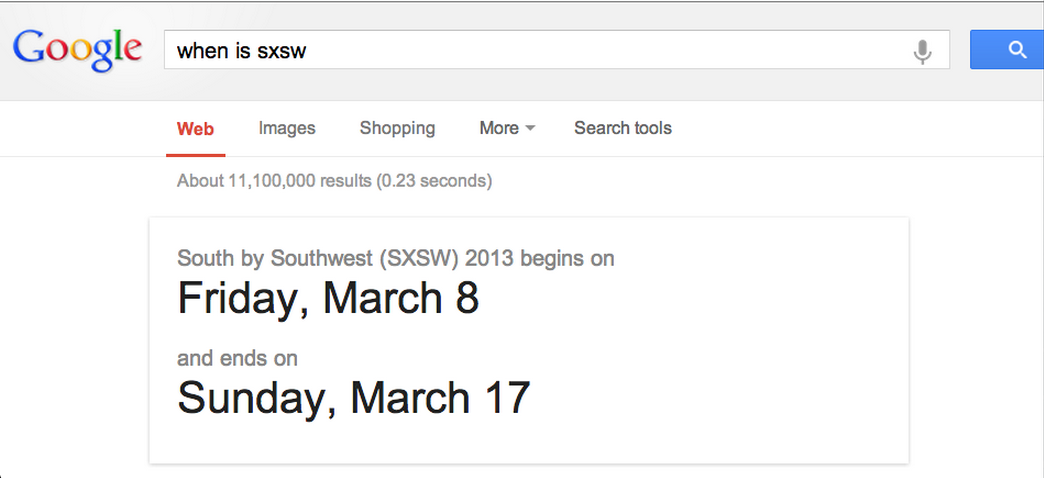

Remember how it set out on a project to tighten up its search so that sites like $DMD and Mahalo lost search juice? Well, one of the tactics of these farms was to figure out what questions around big events people would be asking Google and then to write a quick story in order to try to capture the traffic. Here’s a post I did two years ago around the question “What time is the Superbowl?”.

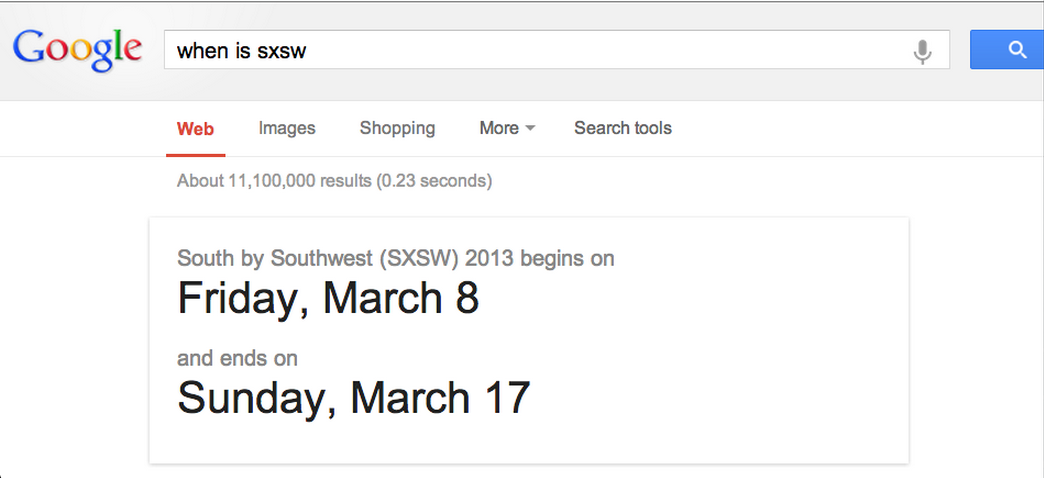

Not only has Google set out to fix its search algo around content farms, it has also begun capturing that traffic for itself. Here’s my friend Stacy Ishmael’s recent search results for “when is sxsw.”

No need to click a link. Sorry Demand Media…

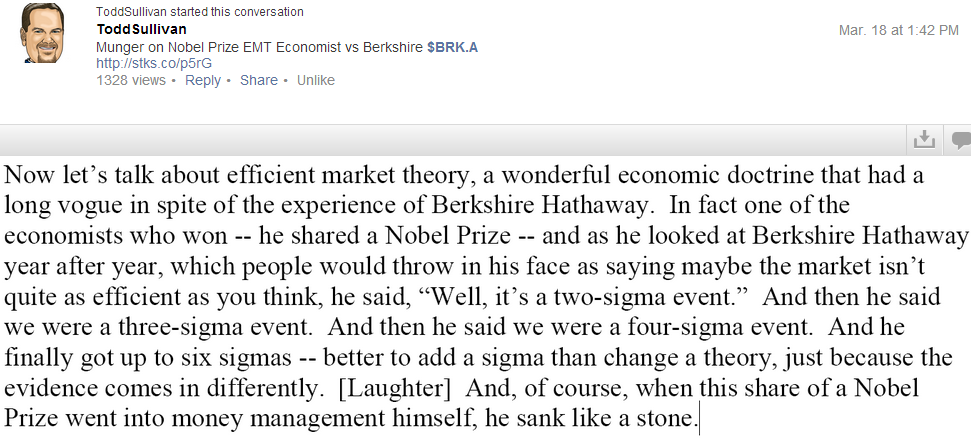

This is all a part of the Google+ strategy. Those who have written G+ off as a failed social network are really missing the play here. Gogle is disrupting the universe by automating and being smarter. Meanwhile, it will motivate businesses to incorporate G+ for the businesses’ own benefit all the while capturing data for the next iteration of automation and capture.

Google is eating the internet by leveraging search in a big way and doing it without creating a walled garden.

Pretty sneaky sis…