Markets have been around forever, eh….

Fridays with All Star Charts: 04/19/13

Friday, April 19, 2013Getting into a nice flow talking stocks Friday afternoon with JC Parets. Its a great little wrap.

This week we chewed on:

1. The big $SPX 1538 level

2. Weak Commodities $KOL, $XME et al…

3. Treasuries

Take a look:

Reconcilable Differences

Wednesday, April 17, 2013Its so very nice when all your indicators line up perfectly.

It would be splendid if the market was showing signs of topping while sentiment was super bullish. Many times, though, we face discrepancies and the markets are not so obliging.

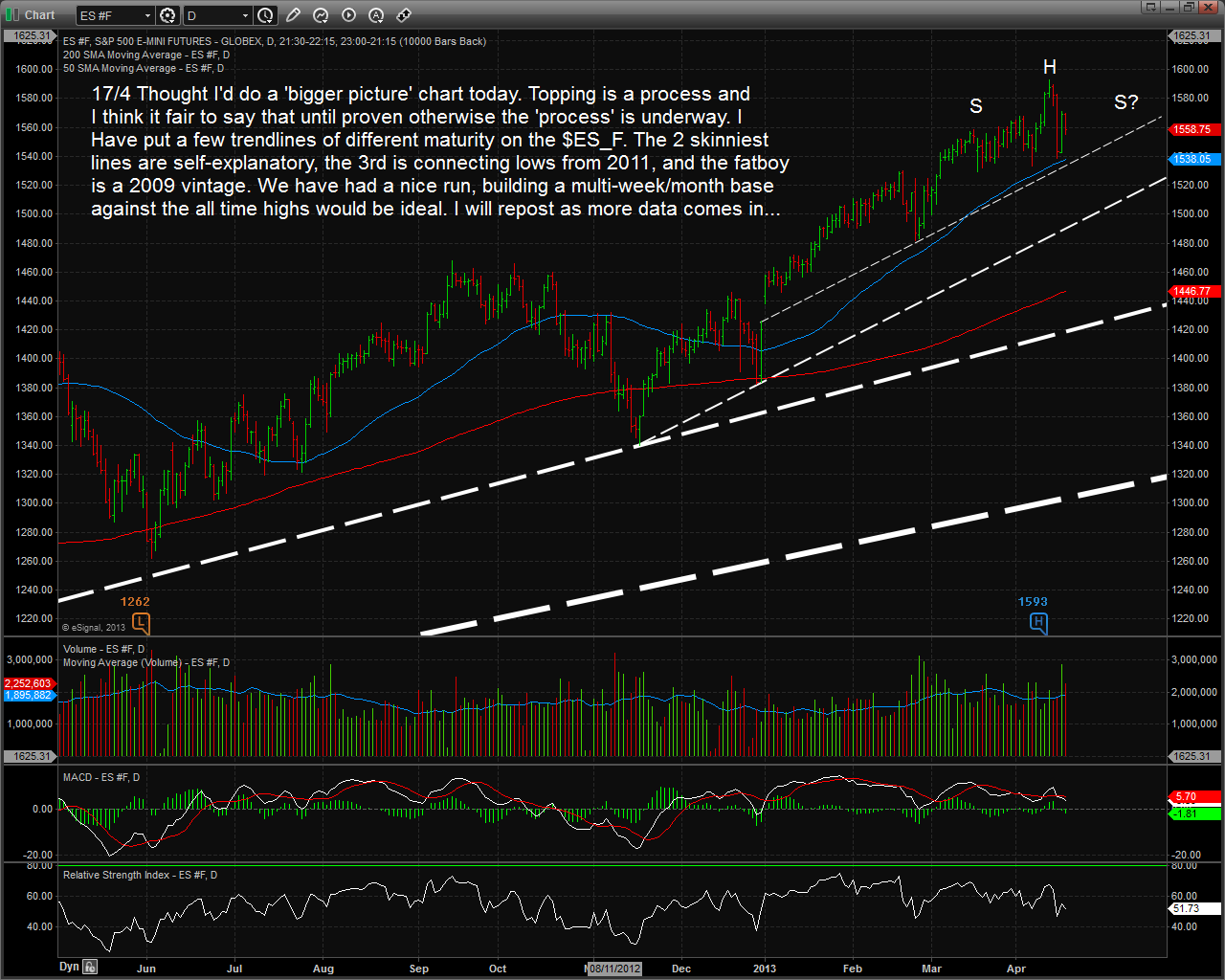

Here’s @wisedom’s chart from this morning that nicely shows, technically, where we are if the market is indeed in the process of topping.

I have been and remain in waiting for the correction mode (see my post Waiting for Godot) so I’m relieved to finally see it looking as if one is shaping up.

It has not been comfortable as the $SPX made all time highs and looked as if it would test or maybe even blow through 1600 sooner rather than later but now the scenario suggests topping and seasonals are also becoming more favorable as sell in May approaches.

So great, commodities are breaking down too and it looks like we will get some fat weekly bearish candles in the major indices come Friday and maybe more damage before traders shift into looking for a bottom mode.

However, I have also been focusing ad nauseam on the very high level of bearish sentiment reactivity and how bullish this has been and potentially remains. What I mean here is that every time the market sinks even a bit, everyone gets very negative very quickly and these episodes look and respond like a bearish sentiment extreme or capitulation that is bullish stocks.

So I am left with apparently opposing signals that are key to how I formulate my market thesis:

1. Price behavior suggesting a corrective process.

2. Sentiment suggesting even shallow dips will be bought.

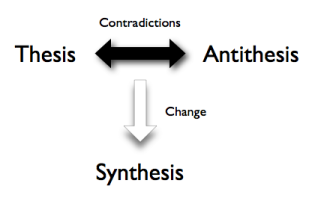

Rather than interpreting the mixed signals dichotomously, I am taking a dialectic path and attempting to resolve at least to some degree.

The key element for me in synthesis is just sitting with the mixed signals, waiting and watching the events play out with all the imperfections no matter how uncomfortable it might be at times. Its just the gray reality at this moment.

Patience.

One last point – it looks to me as if a lot of traders are anticipating the $SPX top in general and the head and shoulders pattern in particular and I recall prior incidences in which very highly anticipated h&s patterns gave false signals and the market continued to rip.

$SPY $QQQ $XLE

The Patriots Day Satellite Project

Tuesday, April 16, 2013Let there be Boston Marathons everywhere!

Half of my stream, it seems, wants to run the Boston Marathon next year in a show of support after yesterday’s horrible attack. I love the sentiment and want to do it too.

Logistically though, if even 5% of the people who are now saying that they’d like to run it, enter and show up, it will extremely difficult if not impossible in Boston, especially with the heavy security that will be present.

But what if we begin to organize satellite marathons across the country and schedule them on the same day as next year’s Boston Marathon?

We can call it The Patriots Day Satellite Project.

This would be great as it would spread our solidarity and support everywhere and allow many more people to run but not add even more stress to next year’s Boston Marathon.

Seems like a no brainer.

I will be in contact with my local Road Runners club today and have more details by the end of the week.

If you would like to help organize, please leave a comment below or ping me at phil at stocktwits dot com.

Let’s do this!

On Gold: Conversation with Kitco’s Peter Hug

I had a quick conversation yesterday evening with Kitco’s global director of trading, Peter Hug.

Peter has been researching and trading the metals since before you were born and he knows the space from every angle. We covered much ground here including:

1. Tracing the catalyst for the selling in gold to Cyprus and the implications for the rest of Europe.

2. Reports of forced selling by funds getting margin calls and the trickle down there.

3. Near term technicals.

4. Global Macro factors related to Europe and the continuation of stimulus in the US and Japan.

5. Copper demand in China.

Watch here:

$GLD $SLV $JJC

Best of StockTwits Charts: Gold Crashes Edition

Monday, April 15, 2013As you are all likely aware, gold is getting crushed, now down 125usd though off last night’s lows in the futures markets.

There have been hundreds of charts relating to the metal posted to The StockTwits Charts Stream in the last 24 hours and many of them are excellent.

I am posting a small sample here and focusing mostly on comparison charts. My thinking is that gold intertwines with other markets (currency, bonds, equities etc) in a complex way and so when we see a move like we have Friday and today, the changes in these relationships occurring as a result are worth noting.

First, Tim Turrenne (@cyclentrade) compares gold’s behavior to its history and contextualizes the extremity of the recent move noting, “more than 3 standard deviations outside the 200 day moving average is very rare.” Indeed:

Next, Christopher Vecchio captures the recent divergence between the price of gold and the 10yr yield on a 6 year chart. He writes, “Gold decouples from US 10yr – are interest rates about to spike?” (note: the price of gold is inverted on this chart):

Steven Place captures the relationship between the Dow Jones Industrial Average ($)DIA and $GLD. He writes, “Dow Jones priced in $GLD now at the highest levels since the 2008 crash:”

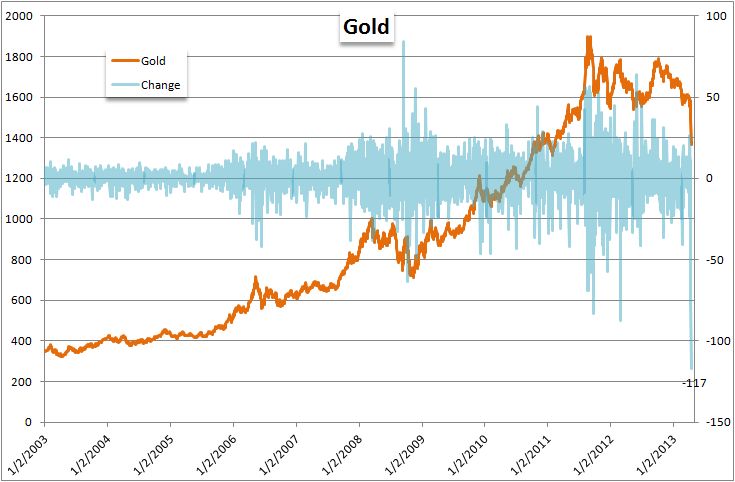

John Kicklighter measures “daily gold changes over the past decade” and this is by far the biggest:

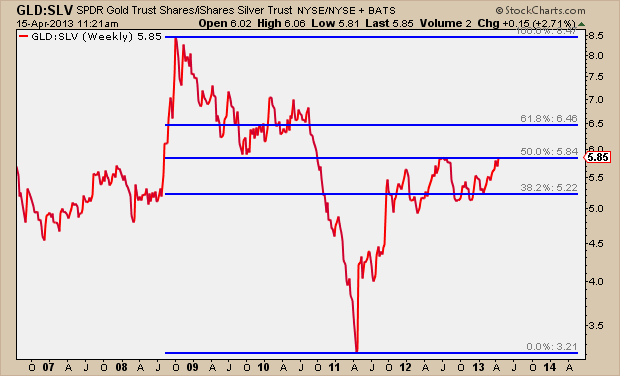

JC Parets compares gold and silver, “the $GLD and $SLV ratio is right at the 50% retracement of the huge 2008-2011 down move:”

Jaime Bermudez compares the recent gold move to its 20% crash in 1983 to 2013:

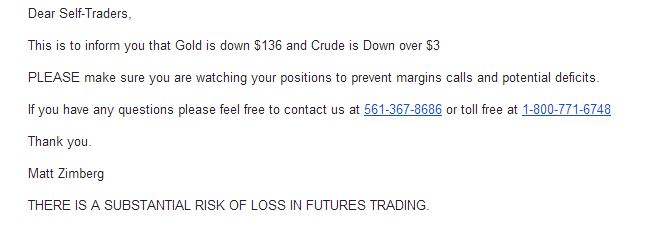

Last but not least, here’s an email @Trade2day1 received twice in the past two trading days from Optimus Futures. It suggests to me that traders are under extreme pressure with these large moves not only in gold but in crude as well:

StockTwits All Stars: Talking Markets with Chris Kimble

Friday, April 12, 2013Thrilled to do the Google Hangouts Session with Kimble Charting Solutions’ Chris Kimble.

For those of you who don’t know him, Chris is a master technician who weaves themes, from the global macro to the historical, through his work in an engaging, provocative and humorous way. We talked the stages of a bull, the Dollar/Yen, the Nikkei, commodities and bonds.

Seriously good…

$EWJ $USDJPY $JJC $GLD $TLT $JNK

Individual Investors Are An Emotional Wreck And It Is Astonishingly Bullish

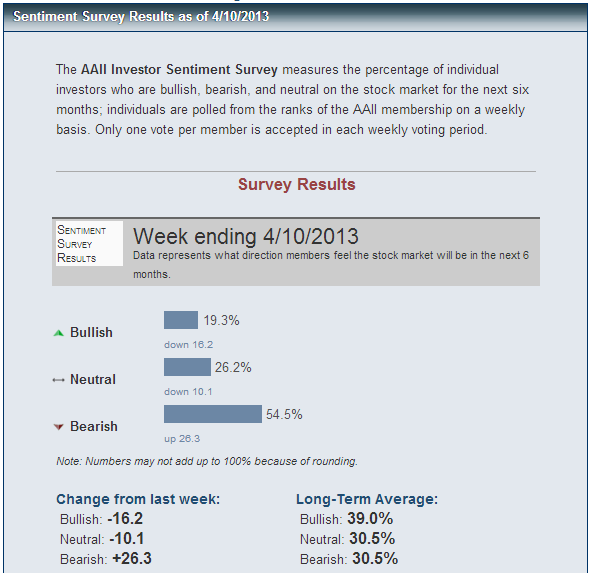

Thursday, April 11, 2013The latest AAII Sentiment Survey again indicates extraordinary reactivity to price.

Last week, the major equity indices pulled back a bit with the S&P 500 losing 1.3% (intraday high to low), the $DJIA a little over .5%, the Nasdaq 2% & the Russell 2000 a little more than 3%.

In response to this shallow correction, however, the sentiment survey shows a huge spike in bearish sentiment of +26.3% from 28.2% to 54.5% while bullish sentiment decreased 16.2% to 19.3%.

While I have been writing and speaking extensively about the high sentiment reactivity for a while now and how it bouys equity prices, I am still surprised by the extremity of it evident in these numbers.

In an environment where sentiment shifts so much on such modest declines, the shift acts like a put or hedge against lower prices. Individual investors are an emotional wreck and it is astonishingly bullish.

Note: For all the latest on the AAII numbers and analysis I highly recommend following Charles Rotblut on StockTwits. He is a VP at AAII, does a great job covering the numbers and much more and he will answer your questions insightfully on the stream.

Related:

Behavioral Finance and the Freudian: An Interview with StockTwits’ Phil Pearlman

$SPY $IWM $DIA $QQQ

Best of StockTwits Charts: Bitcoin Crashes Edition

Wednesday, April 10, 2013Today’s Bitcoin crash was captured exquisitely on the StockTwits Charts Stream.

First, @pinkhasov posts a screenshot of the spark that may have set off the crash, a denial of service attack on major bitcoin exchange sites:

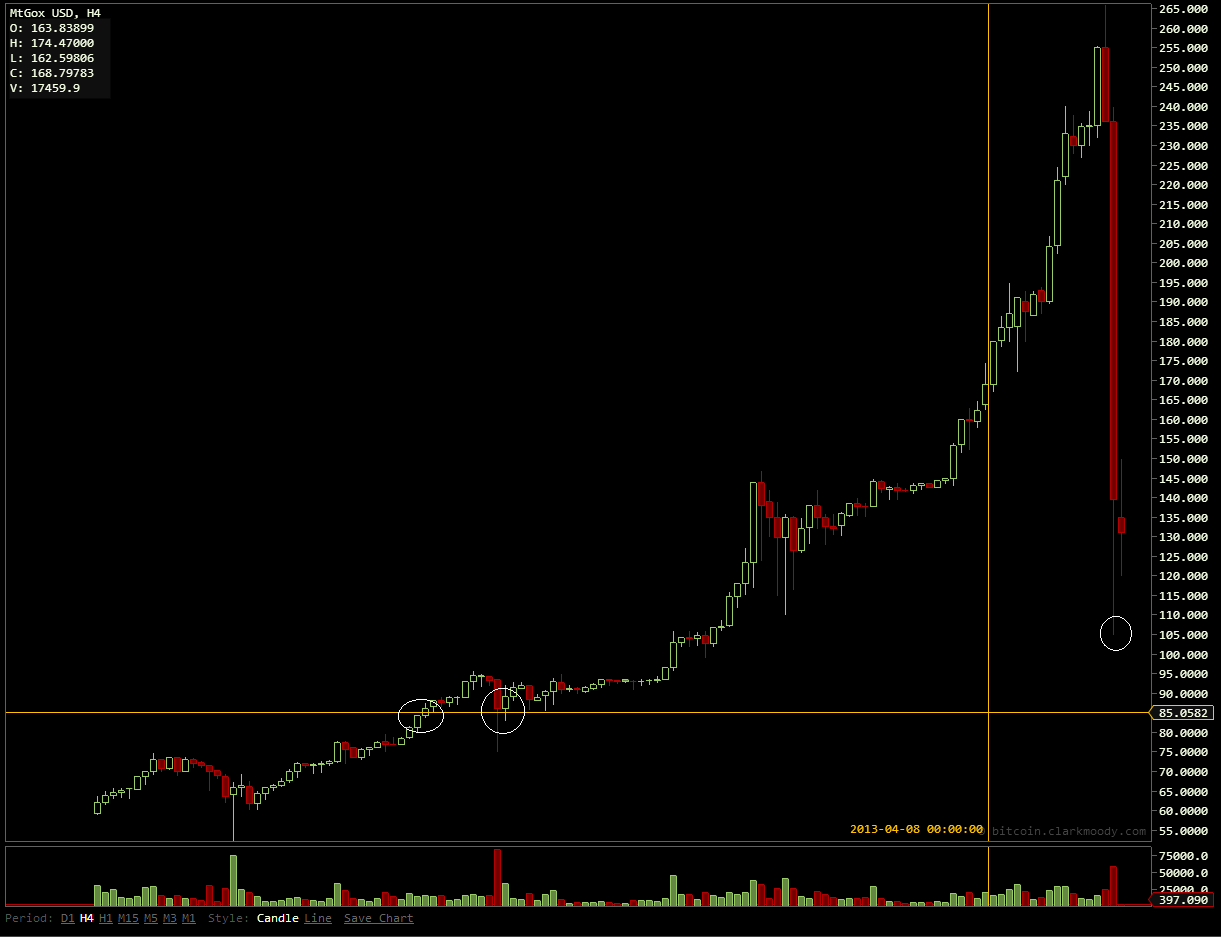

Next, @jaquatech captures the majority of the damage with 4 hour candles:

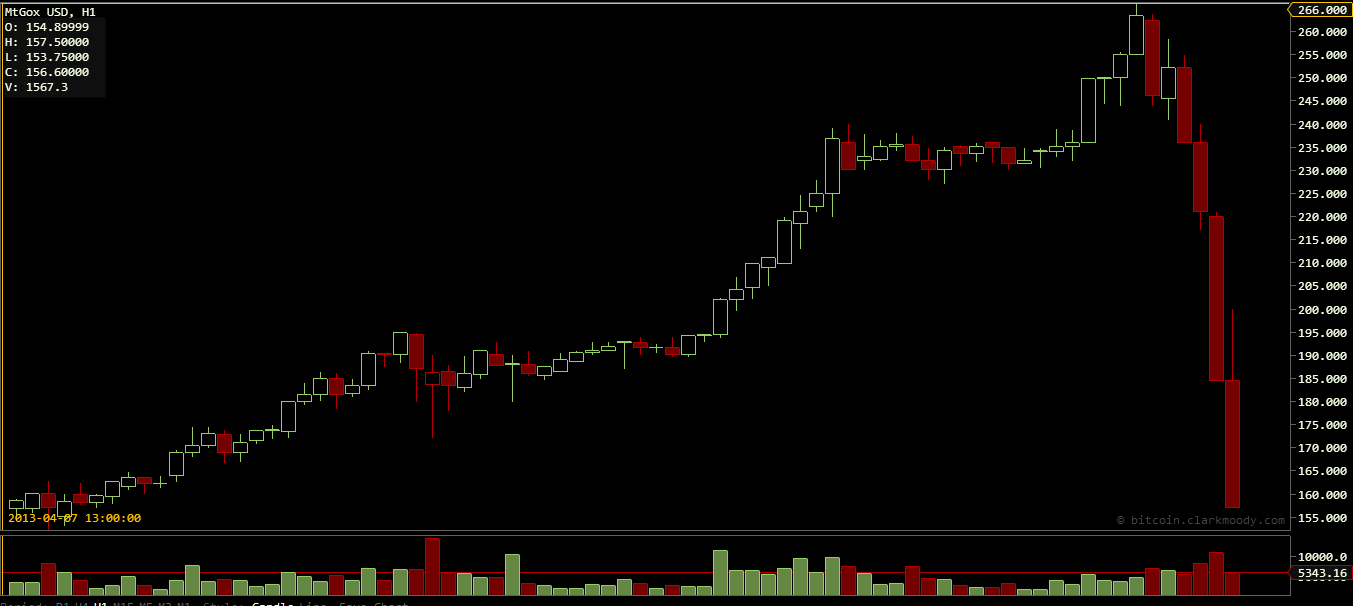

Love this 24 hour view in 1 hour candles via @1nvestor as it shows how volatility increased with the slope of the decline. Classic crash pin action:

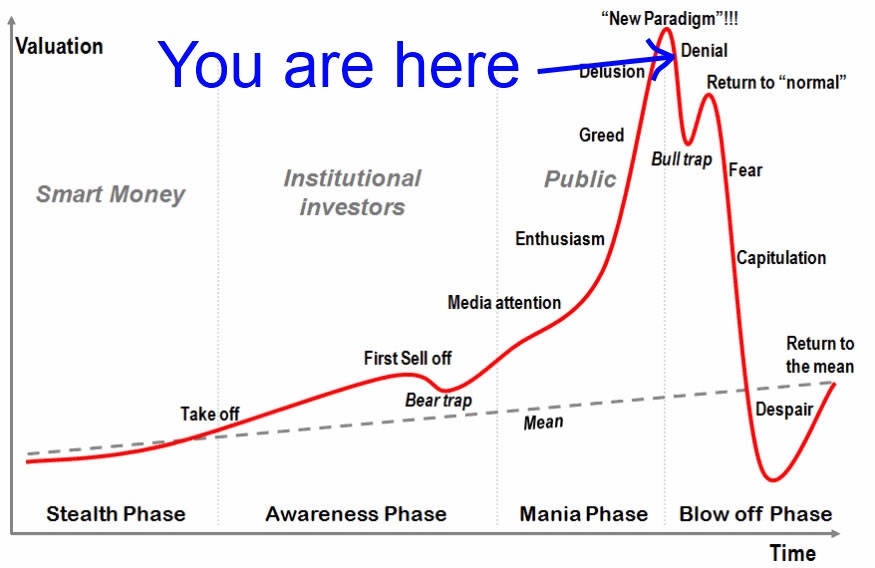

Next, this one, simply titled You Are Here and posted by @KarSun1, captures the bubble/crash cycle phenomenon generalized and speaks for itself:

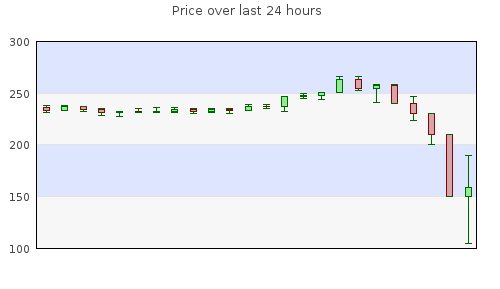

Finally, one last chart from @hakihika posted Tuesday still during the ascent and prophetically captioned, There is no way this doesn’t end in tears:

Nice jobs fellas.

Bitcoin Is Crashing

I have been posting these Bitcoin charts to StockTwits for a couple weeks now.

As I am writing, $BCOIN has crashed more than 100 points off its highs earlier this morning though I am sure by the time you are reading this the price will have changed drastically again.

This is not so much a currency but much more a pure distilled version of what animal spirits look like. It is a rare lens into speculation as element.

Let me quickly explain. Every extended overreaction (or bubble if you want to call it that) has a story and asset underlying the lunacy that has some value. In the case of the NASDAQ bubble, the internet was truly transformative though the price action obviously got way way way ahead of reality.

During the housing bubble, there were houses and real property.

But what if one could have separated any intrinsic value in the NASDAQ stocks or the houses from the speculative activity and looked only at the speculative activity? Well, we couldnt, not even in hindsight perfectly.

But with bitcoin we dont have to because there is no underlying asset, there is no intrinsic value.

So we are left with a hollow trading vehicle with limited liquidity getting moved purely by speculation.

Its glorious and tragic and why I am so interested.