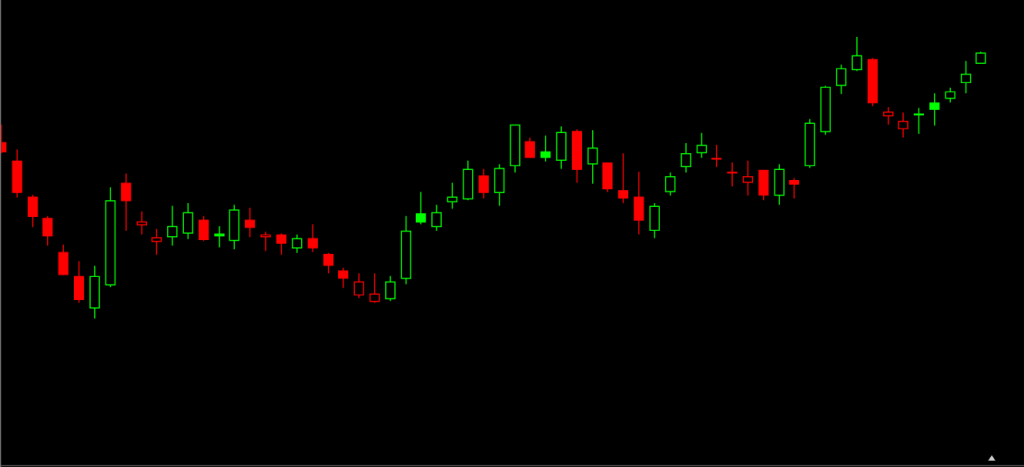

For years, I have been tracking sentiment volatility or reactivity.

I use the term reactivity because I am really just observing how extreme the emotional reaction is when the market corrects or changes trend.

If the market mood doesnt really change much when the market corrects, I call this low reactivity. When the mood changes quickly with an extreme swing that is exaggerated relative to the magnitude of the price correction, I call this high reactivity.

High reactivity indicates an underlying impairment in collective investor psychology. Instability. Neuroticism.

Think of the people you know and how they react to negative news. Some are even keel, while others overreact over small things. This second group is neurotic.

Reactivity remains high as I take note of how loud the bearish drumbeat has gotten on this 2% pull back from new YTD highs.

Europe matters again, QE infinity is a bust and we are heading back to 1257 and beyond…

This is just anecdotal based on my read of the media and the stream but I think it will be backed up by an AAII investor sentiment numbers tomorrow. Look for a big shift towards bearish that is skewed very negatively relative to the YTD and more recent performance of stocks.