Its absurd that universities still do not formally teach the study of price behavior (technical analysis) and it seems academic finance is way out of touch with real market participants and real risk management.

The study of price behavior is as basic to markets as the study of human behavior is to psychology. It is directly observable. There is price, volume and time. Nothing is hidden or subject to conjecture. There is no implying.

There are really only 3 behaviors – buy, sell and hold and charts are, concretely, the visual depiction of the collective market exhibiting those behaviors.

Patterns repeat themselves. They do not do so perfectly and predictive validity is nowhere near 100% but that’s not the point.

The point is that there are behavioral tendencies which reveal themselves upon disciplined scrutiny and that there already exists a rich written history and archive of those tendencies.

Real market participants gravitate towards technical analysis for good reasons. It provides them an edge.

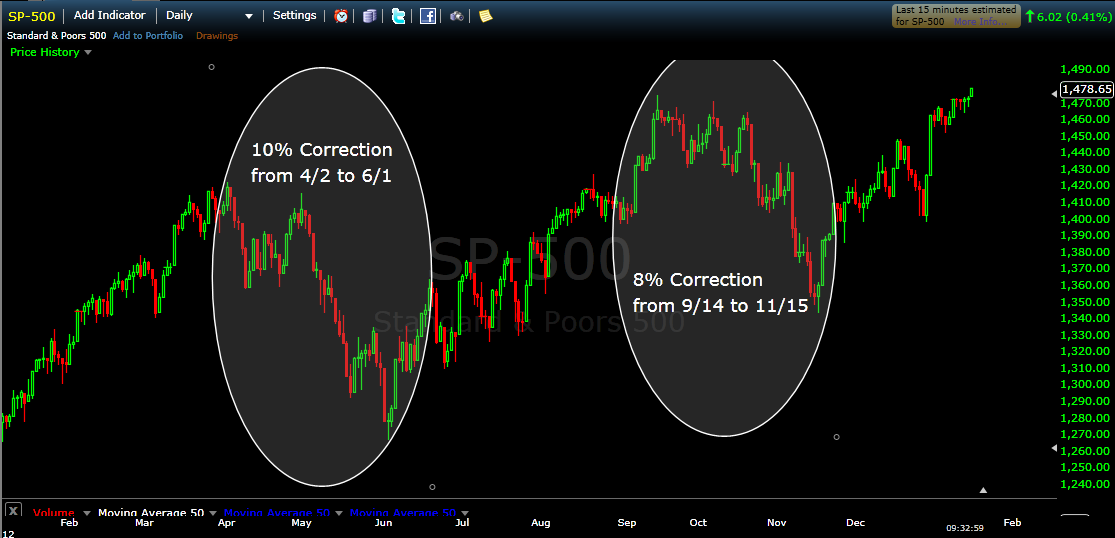

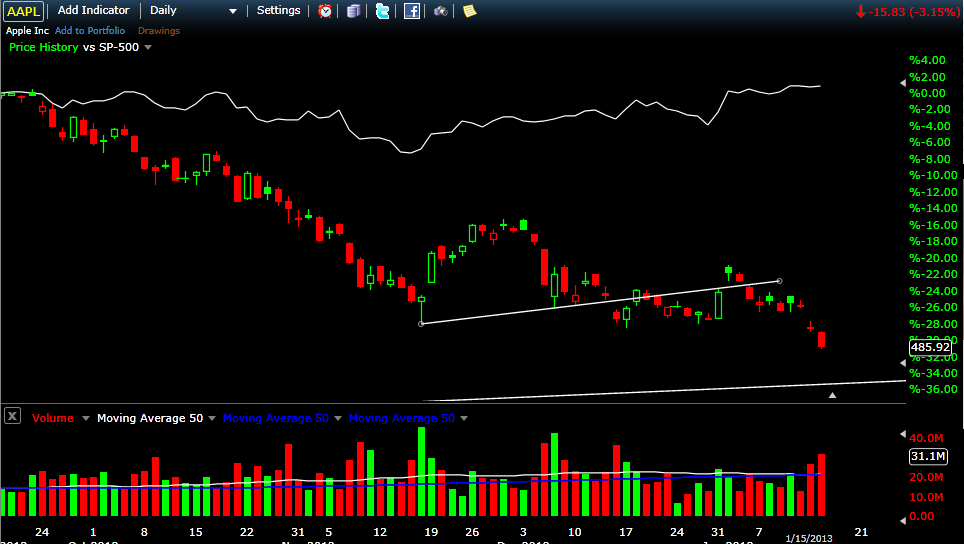

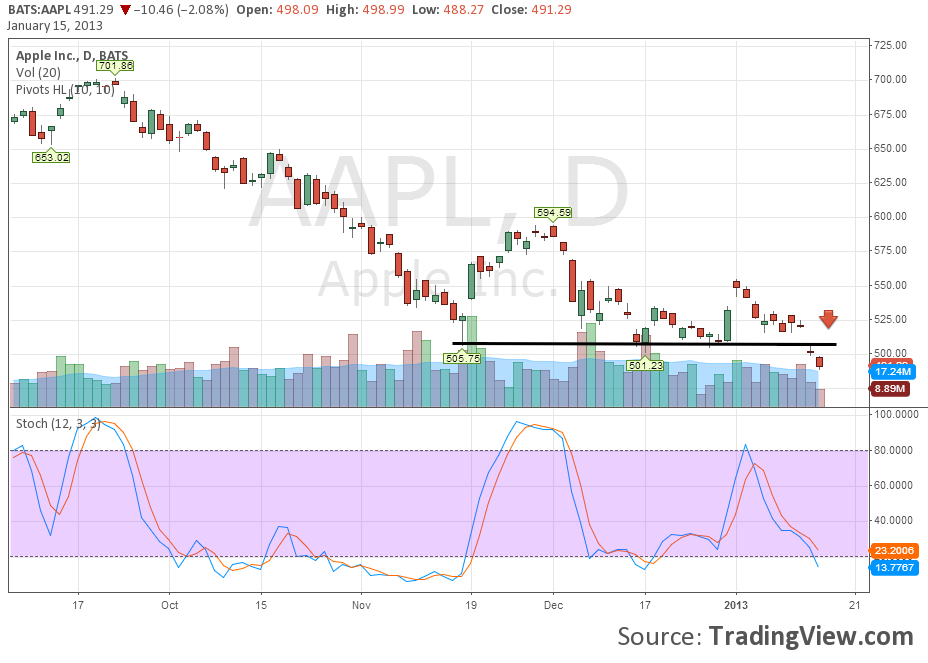

As mentioned above, behavioral patterns repeat themselves again and again across assets and time frames. These are the tendencies and they provide essential tactical information.

The disciplined employment of price study facilitates risk management. If you are long and wrong, how do you know? How do you plan ahead so that losses do not get away from you?

When a rational participant enters an investment or a trade, he must have risk defined. If he does not, he is placing risk management responsibilities on a future self that might be affected by the loss he is experiencing in the moment and we know that decision making while experiencing a loss is wrought with problems. Defining risk is a multi step process no doubt but an integral part of it must be an informed examination of price.

Further, and in reality, it is not only technically driven investors who incorporate price behavior. Real world fundamentally focused investors use price studies to find entry and exit points. They are already integrating technical analysis into their work.

Academic finance ought to be accelerating price behavior research and challenging students with what we understand, what we don’t understand, the questions that need to be answered and challenges for future study.

Instead, it goes ignored due to biases inherent in academia. Fischer Black summed it up like this:

In the end, a theory is accepted not because it is confirmed by conventional empirical tests, but because researchers persuade one another that the theory is correct or relevant.

Its a bias on the part of finance academia against technical analysis from a community that is still trying to prop up EMH and has moved so far from the reality of markets they fail to acknowledge critical tools their students will be using in the future.

The good thing is that it is becoming easier for those learning asset management to find educational material in books and on the internet and so universities are only risking moving themselves further from being relevant much less essential.

This will need to change fast so that future managers will grasp the essentials of technical analysis before heading into a real world filled with real profit and real loss.

If you want to support technical analysis being added to curricula, please connect with the Market Technicians Association Educational Foundation. It is their stated goal to make this happen.