Early last year, I posted this 30 year General Mills ($GIS) chart.

It was such a beauty and I bought some for the kids and retirement accounts.

The very long term trend is sublime, though in hindsight I’m sure those who bought in the middle of 2008 did not feel that way as even such a stable business lost more than 1/3 of its market cap while the financials were crashing.

Fast forward this $GIS chart to today and we note another unusual deviation from the very long term trend line.

Since the beginning of the year, the slope of the trend has increased dramatically as $GIS and her cohort have begun behaving like momentum stocks.

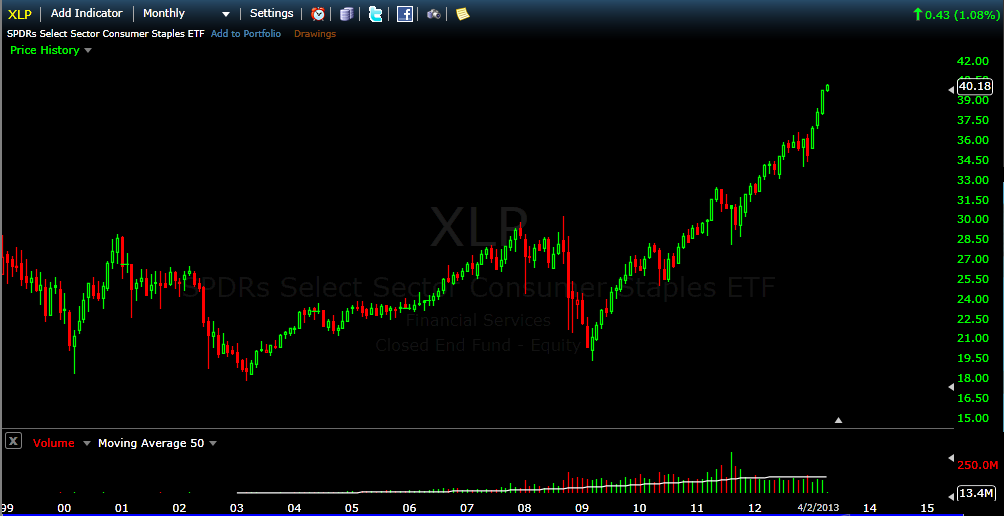

Here’s a 15 year chart of the staples ETF $XLP and you can again observe the increase in trend slope that has accelerated since the beginning of the year.

$XLP includes names like $PG, $PM $WMT $KO $COST et al and there are new momentum gems galore in the full list which is notable because consumer staples stocks are not usually momentum names but more defensive, dividend paying and stodgy.

So the $GIS rip coincides with price momentum among consumer staples as a whole as well as other defensive sectors namely health care.

Here’s 6 Takeaways from this most unlikely area gaining the mo…

1. There’s a bit of truth in every bubble that gets more and more distorted over time. You can think of it as the demonic charge or the thing that gets the bubble going in the first place until the price momentum takes on a life of its own.

With the NASDAQ bubble it was the real universe changing awesomeness of the internet. With the staples, it it the defensive aspect and dividends during a period when stocks seem unsafe and dividends are harder to come by.

2. The change in character among these names is not in and of itself healthy or unhealthy. It does though signal a deviation from normal asset behavior and where there is one deviation, others have usually already occurred or will occur either above or below the surface. You can even think about this boom, in part, as a derivative of sustained abnormally low rates.

3. This could last a while. These stocks are under owned and are not generally the focus of trader or media attention. As such, there is plenty of room for them to gain fashion with momentum crowds.

4. They will correct abnormally. Because you are getting increased volatility and volume, you will also get larger and faster corrections.

5. Nothing is immune to a bubble. Tech stocks are a lot sexier than Cheerio’s and when we think of the types of stocks that can get caught up in momentum, we usually would not think of these names as susceptible. Doesn’t really matter, does it?

6. In the loneg run, $GIS and the others that are right now becoming darlings will return to their longer term trends after the party and hang over are through. If you are a long term investor, there’s not much you really need to do here except maybe enjoy the ride while it lasts.

Related: General Mills: People Will Always Eat Cheerios