On the last day of the 1st Quarter, the S&P 500 finally made its much anticipated All Time Closing High joining the Russell 2000 and the Dow Jones Industrial Average which made all time closing highs earlier this year.

Meanwhile though, individual investors continue to raise cash.

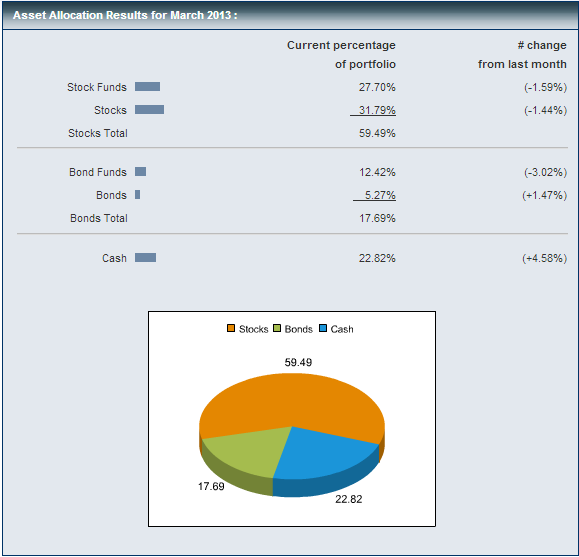

In the March data, published by The American Association of Individual Investors, cash grew by 4.58% while money allocated to stocks and stock funds declined by 3.03%.

You have a combination of stocks making all time highs and individuals increasing their cash positions and decreasing their equity risk exposure. Bearish persistence still at work and not the thing that tops are made of.

Read: March AAII Asset Allocations Survey (AAII Blog)

Pingback: Tuesday links: balanced portfolio blues - Abnormal Returns | Abnormal Returns()