Month: March 2013

End of Week Wrap With JC Parets

Friday, March 29, 2013JC Parets and I have begun making end of week videos using the Google Hangouts.

They are quick, sharp and fun and we will get better and better at thm with every week I think.

In the latest one we discuss the S&P 500/Vietnam pairs trade, the Q1 underperformance of the financials and the Lulu Lemon short.

Check it and please feel free to provide feedback as we get this thing going:

$VNM $SPY $XLF $LULU

2nd Quarter Outlook: Waiting for Godot…

Thursday, March 28, 2013What are we doing here, that is the question. And we are blessed in this, that we happen to know the answer. Yes, in the immense confusion one thing alone is clear. We are waiting for Godot to come — ” – Samual Beckett

Few corrections have been more highly anticipated than the one we are all awaiting here. My great uncle Chuchum even asked me about it the other night at Sedar, “Boychkl, vooch with this correction?”

Few corrections have been more highly anticipated than the one we are all awaiting here. My great uncle Chuchum even asked me about it the other night at Sedar, “Boychkl, vooch with this correction?”

With so many so eager, no wonder it never gets here. Its like the watched pot or, to get more existential on you, Beckett’s Vladimir & Estragon waiting for Godot.

Well, if recent history is any guide, we’ll get it in q2 which begins with the opening bell on Monday morning. That’s a 65 trading day window and an eternity for many traders with a shorter time perspective, but if you are longer term oriented then you can afford to be patient and employ time to your advantage.

My view has been that we are in a bull market as a direct study of price behavior indicates. The $SPX is up 135% from the 2009 lows. That’s a bull.

Equities have been fueled by an astonishing percentage of money out of the market and in money market and treasury funds. As I blogged in September, making a bullish case on the report that Fidelity’s bond and money market assets comprised more than half of the company’s 1.6 Trillion in managed assets:

Let’s think about this for a sec. The public hates the market so much that for the first time ever Fidelity has less of its AUM in equities than in bond and money market funds.

Furthermore, no one is talking about the epic level of dry powder this data point implies.

Despite 2012′s 15% $SPX rally, capital loss remains the primary emotional motivator of the investing public now.

Such an aversion does not get worked off overnight, or in a month, or in the 6 months since these numbers were reported.

Nevertheless, bull markets correct periodically and so will the current one and there is a rhythm.

Let’s use 2012 as an analog.

For Q1 2012, the $SPX was up 12% without a 5% pull back. For Q1 2013, the $SPX is up 10% without a 5% pull back. So far, a similar script. For the full year 2012, the $SPX did correct twice, once during Q2 for 10% and then again into Q4 for 8%. Rhythm.

I expect the similarities between 2012 and 2013 to continue and that we will have a pair of corrections within the context of a bull market fueled by persistent loss eversion.

I have been gradually lightening positions since February expiration and so I am underinvested here and getting more so. I will be looking to scale back in when the market gets pummeled.

I risk missing a bull that never corrects. I’m good with that and for now I’m just waiting…

The European Noise Festival

Wednesday, March 27, 2013If you are having difficulty deciphering noise from information, I will help you –

ITS ALL NOISE.

There are so many sources competing for your eyeballs and they will say anything to get you to allocate your precious time and energy that would be better spent focusing on your own method and goals.

The same exact thing was happening when I had dinner with Lydia more than a year ago and she said,

I’m done with Greece and don’t pay attention to it. I don’t care. Its in the market. It has been in the market. You can see it in equity prices. They don’t care either.

Well guess what, the $SPX is up 200 points since then and even if it was down 200, staring at Greece’s navel would have produced zero alpha.

You only have so many minutes and so much energy in a day and 98% of Cyprus and Europe were in the market by the close on Monday March 18th.

The world is so complex that no matter how smart you are and how many blogs you read, you will not have an information edge amid this glorious festival of noise.

$SPY $GREK $FXE

Gold Topped and the SP 500 Bottomed on the Same Day In October, Implications…

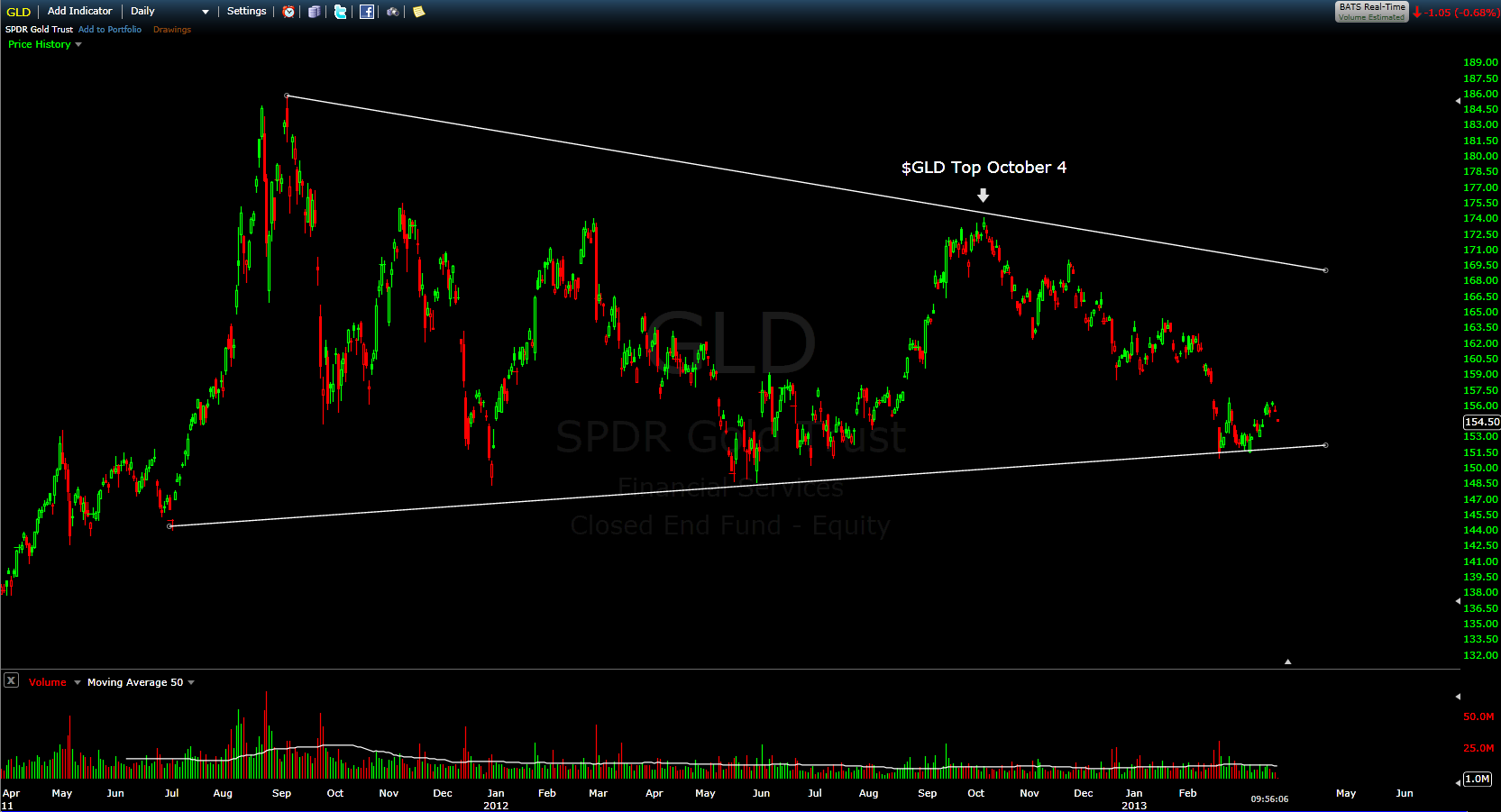

Monday, March 25, 2013I have been watching this huge consolidation in $GLD since December. Here’s the chart posted then:

And here’s an updated $GLD chart from this morning zooming in on the narrowing range:

$GLD topped on October 4th which just happens to be the same day that the $SPX bottomed.

Aside from the convenient symmetry there, I take note of this as we near the bottom trend line in $GLD. A break below that level, signaling a breakdown, may indicate bullish for equities.

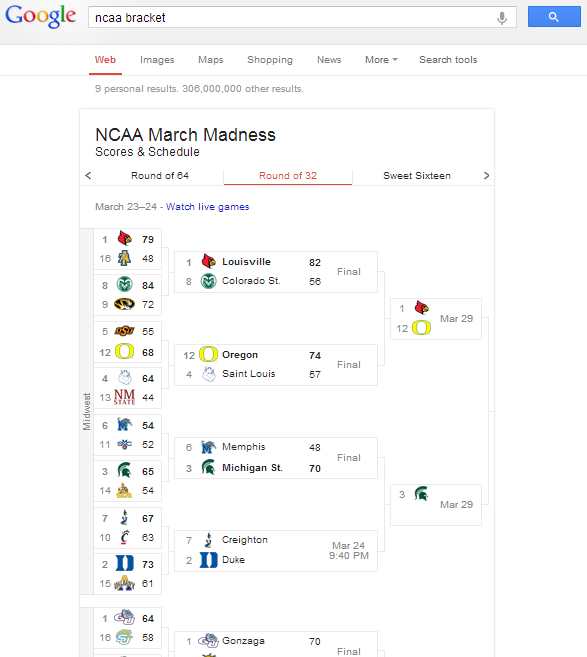

Update: Google Is Eating the Internet NCAA Edition…

Sunday, March 24, 2013Quick update on the Google Is Eating The Internet post from a few days ago.

If you search NCAA Bracket or a bunch of other searches I am sure, you get this interactive graphic below. Its so well done and only goes to show the level of thought and design goodness that $GOOG is putting into capturing page views they once sent away…

Sorry ESPN…

Be sure to click though to the interactive and play with it a bit…

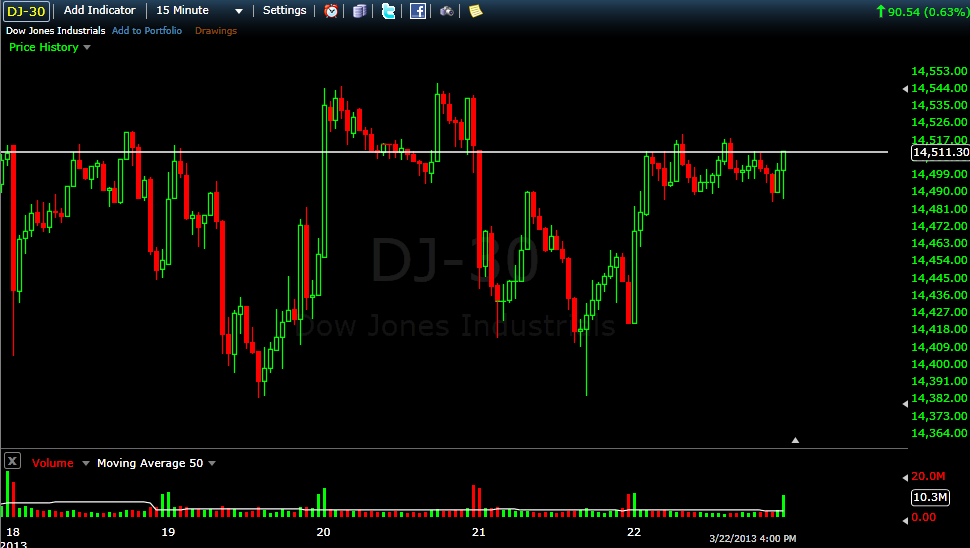

The Dow Jones Plunges .00013 Percent This Week on Cyprus Panic!

Saturday, March 23, 2013

It was Cypriotic.

This past week the mediashpere frenzied on the prospects of a Cypriot bank run after the country reported that it would tax accounts.

It began on Saturday and I warned then that this was way out of proportion.

Sunday night, futures dropped as much as 2%, fueling the fire and the S&P opened Monday morning down 15 handles.

Headlines everywhere spread loaded words like contagion and I wrote Monday morning:

I was not at all surprised by how quickly panic readings went from 0 to 60 on this Cyprus and have recently posted about the high emotional reactivity epidemic among investors here and here.

Many are waiting anxiously for the next shoe to drop. We have been conditioned by market behavior and macro events over 14 years of bubbles, crashes, wars and political incompetence.

Reading this post will not help you recondition but writing about your experiences in excruciating detail and then reviewing your writing later for processing might.

Cyprus is the size of a peanut and in the scheme of things, who really cares. Could this be the beginning, the catalyst, of something much bigger, perhaps, but likely it won’t be.

Its just sentiment reactivity people and its a bullish indication as it behaves like a protective put beneath the market when events look like extreme sentiment bottoms on the snap of a twig.

The nation and the collective market participant is so frazzled by an enduring uncertain and sometimes shocking environment, that the natural tendency is for people to overreact and when we are in such an environment for a prolonged period of time, we tend to overreact x10 and without rational cognitive mediation.

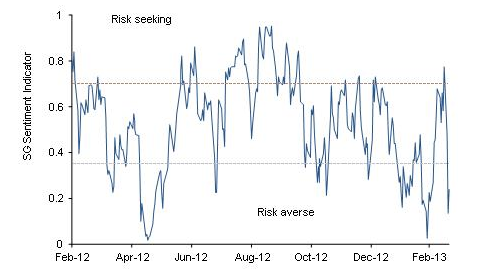

Here’s a great chart @finansakrobat posted to StockTwits on Wednesday of the SocGen Sentiment Indicator depicting the “spectactular turn for sentiment” into Risk Averse territory. Wow:

We don’t think about it, we just freak it.

If the market is going to correct here, and it may, its not going to be because of Cyprus though you will hear ridiculous hindsight attributions along the way.

Make sure you have a plan going in and stick with it as long as it is a good one.

Related:

Panicking About Cyprus? Here’s What To Do First

Google Is Eating The Internet

Wednesday, March 20, 2013Early on, while every internet company was trying to get you to and keep you on its website, Google was busy sending you away happy. People would go to Google to search, find what they were looking for and then leave. It was a genius and counterintuitive move.

With the public launch of Gmail in 2007, that strategy started shifting as $GOOG began keeping users on its site for longer and longer periods as they managed their email. Next came a whole host of other services including Drive and Google Plus, which are also more traditional in that they are also intended to engage and keep users on site.

Google has also shifted the way in which search influences user behavior. When once it was all about helping you find the external web page you were looking for, now it is more about giving you what you were looking for directly.

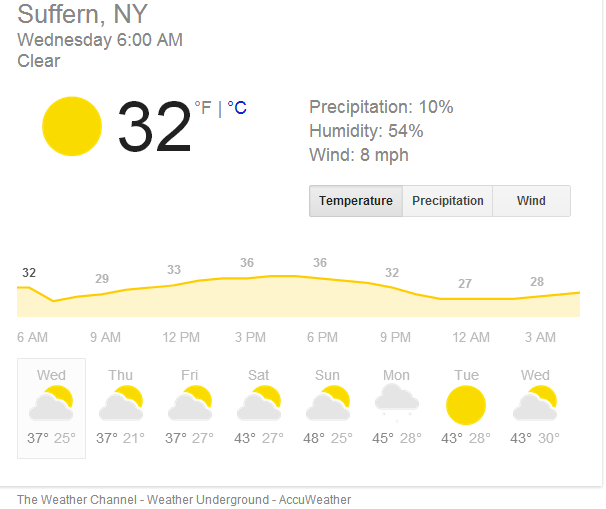

Take, for example the weather. This is what I get at the top when I search Google for weather 10901:

Beautiful. This is simple and all I wanted. So, instead of giving me the best weather sites, it just gives me the information I wanted. I no longer need to go anywhere else.

Sorry, weather.com.

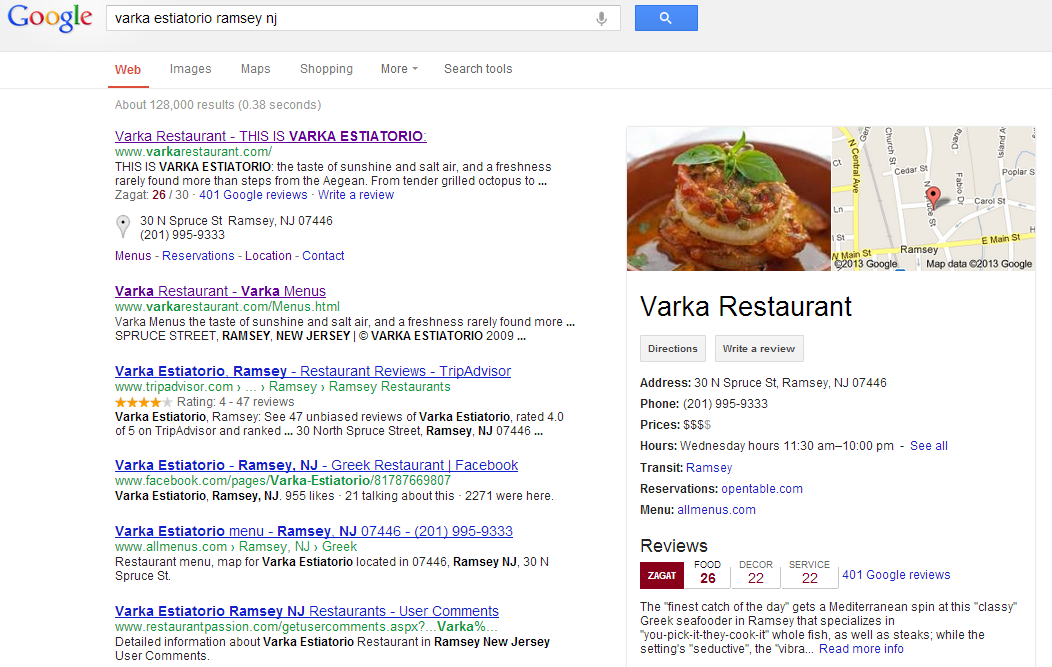

Its not only the weather. Here’s what I get when I search for the wonderful varka estiatorio ramsey nj:

Nice little Zagat integration, sure, but also note the 401 reviews. Not only that, but when you click Read more info you go to Varka’s Google+ page. That little hyperlink is super important for a couple of reasons. First, it motivates restaurants to get on G+, make their page look nice and keep it up to date.

They will also be rewarded for doing this in search results (believe it). Second, its a shift from the way $YELP handles the restaurant as it gives more control to the restaurants who can now fill the page with great photos, specials, whatever they like in order to make it appealing users.

Sorry Yelp.

Not only is Google disrupting $YELP here with minimal effort and lower costs, but they are setting the stage for every business to need to set up and update its Google+ page.

Google is also disrupting content farms.

Remember how it set out on a project to tighten up its search so that sites like $DMD and Mahalo lost search juice? Well, one of the tactics of these farms was to figure out what questions around big events people would be asking Google and then to write a quick story in order to try to capture the traffic. Here’s a post I did two years ago around the question “What time is the Superbowl?”.

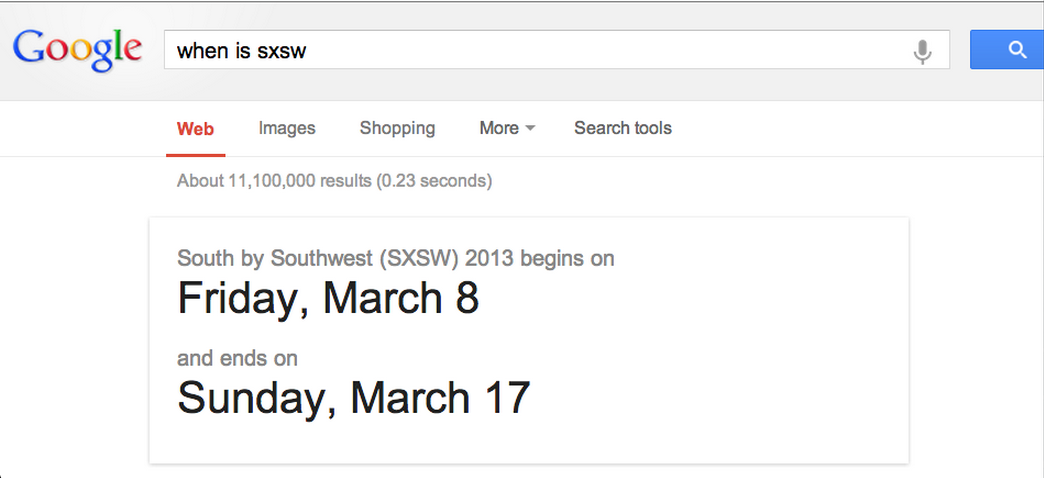

Not only has Google set out to fix its search algo around content farms, it has also begun capturing that traffic for itself. Here’s my friend Stacy Ishmael’s recent search results for “when is sxsw.”

No need to click a link. Sorry Demand Media…

This is all a part of the Google+ strategy. Those who have written G+ off as a failed social network are really missing the play here. Gogle is disrupting the universe by automating and being smarter. Meanwhile, it will motivate businesses to incorporate G+ for the businesses’ own benefit all the while capturing data for the next iteration of automation and capture.

Google is eating the internet by leveraging search in a big way and doing it without creating a walled garden.

Pretty sneaky sis…

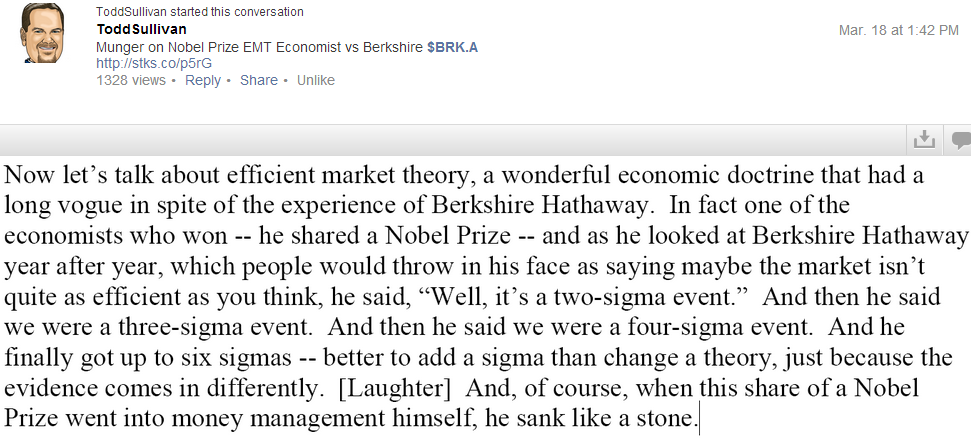

Munger on Efficient Markets Theory…

Monday, March 18, 2013Panicking About Cyprus? Here’s What To Do First…

If you were panicky last night or this morning because of Cyprus, take some minutes today to write yourself a letter describing in detail your experience.

Then save it and take a look at it tomorrow or in a week or whenever you have calmed yourself down a bit.

How were you feeling precisely and in detail?

What thoughts were running through your mind?

What market behaviors did you take and why?

Did you have a risk management plan already expressed before the weekend? Did you stick to it?

What were the information triggers which may have increased your arousal? Do they matter to your plan?

I was not at all surprised by how quickly panic readings went from 0 to 60 on this Cyprus and have recently posted about the high emotional reactivity epidemic among investors here and here.

Many are waiting anxiously for the next shoe to drop. We have been conditioned by market behavior and macro events over 14 years of bubbles, crashes, wars and political incompetence.

Reading this post will not help you recondition but writing about your experiences in excruciating detail and then reviewing your writing later for processing might.