When you have a gargantuan speculative bubble, the majority of wildly overpriced assets never even come close to returning to their old high prices much less surpassing them.

400 years ago, at the height of tulipmania, a single bulb sold for the 34,584$ in Amsterdam and today, 400 years later, one sells for a quarter.

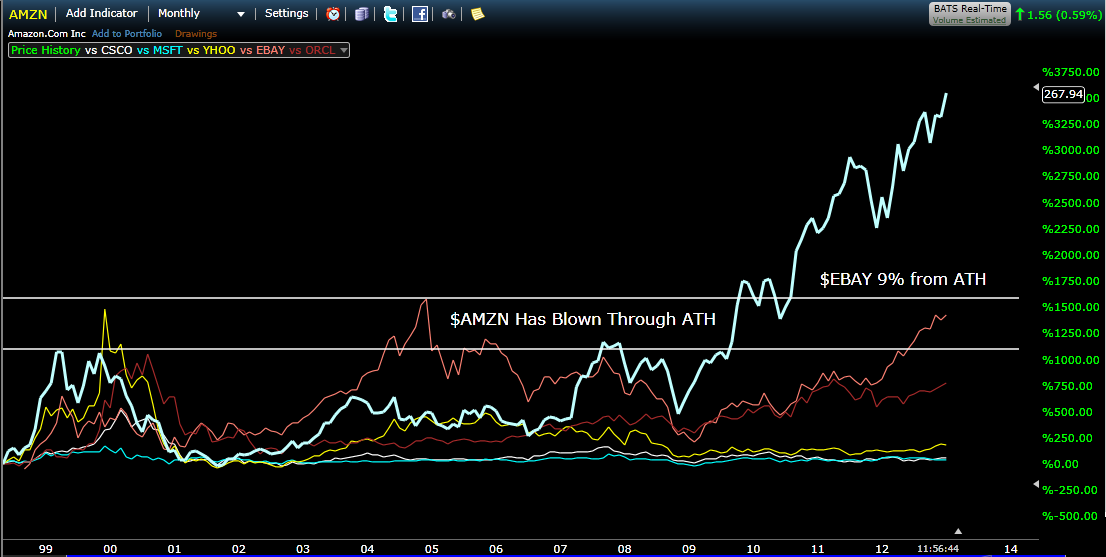

If you look at the great stocks of web dot one, you will notice that none of them have come even close to breaking the bubble highs set in 1999 or during the first half of 2000.

$ORCL would need to rise by 40% to make an all time high.

$MSFT would need to double.

$INTC would need to quadruple.

$YHOO would need to sextuple.

You get the drift…

Except, of course, for $AMZN which has not only surpassed its 2000 high around 113 but has more than doubled.

Indeed, Jeff Bezos won the internet.

Note: $EBAY, also an eCommerce play is the other of the original crew to at least be making a run for the money, now less than 15% from the ATH set a bit later at the end of 2004. It gets the Place.

Pingback: Wednesday links: paying for mediocrity - Abnormal Returns | Abnormal Returns()