Back in the day, before NASDAQ 5000, Intel, Microsoft, Dell and Cisco were known as the 4 horsemen of the NASDAQ as they dominated the index and created incredible wealth for shareholders over an extended period of time.

It will be 12 years in March since the NASDAQ crash began and these stocks have not fared well in the interim.

Since the 2000 top, $CSCO is off 75% plus, $DELL is off almost 75%, $MSFT has lost half its market cap and $INTC has lost nearly 2/3 of its value.

Much more recently though, $INTC and $MSFT have been trading extraordinarily well and have garnered more attention on StockTwits and in the media (Disclousre: I am long Intel).

Nothing remotely like the truly epic action back in the day but still noteworthy with $INTC making 3 year highs this month and up well more than 30% from its September bottom and $MSFT climbing 15% in 3 months and 8% already in 2012.

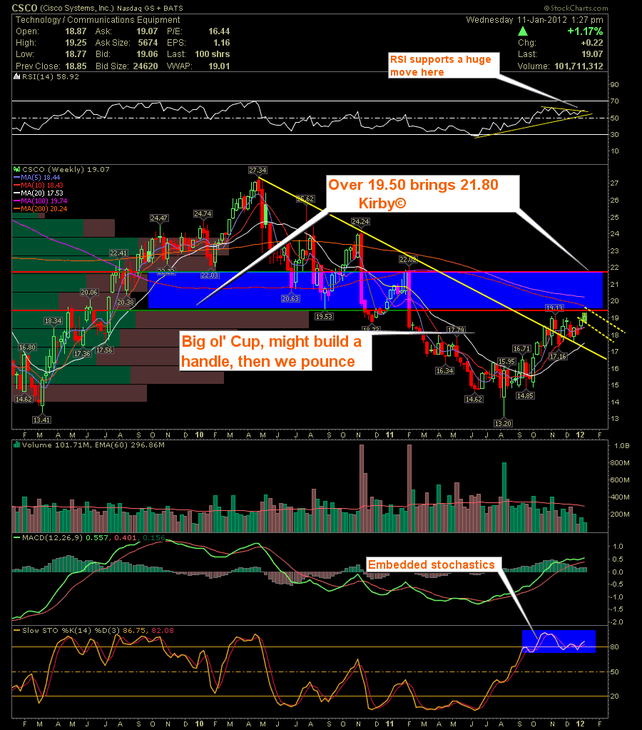

So I’ve been taking a look at $CSCO to see if this original horseman might also be setting up and took note of no breakout yet but what looks like a clean rounded bottom.

I asked my bud, expert chartist and mad genius behind Day Trader Bootcamp, Ron Roll (AKA: @gtotoy), what he thought and he sent me along this weekly study which is also constructive.

Take a good look. Ron adds that he likes a break above 19.5 with a stop at 17.53 or building a position on a drift lower as it forms a handle.

*For those unfamiliar with The Goat’s creative nomenclature, by Kirby he means vacuum. 🙂

Pingback: Morning News: January 12, 2012 | Crossing Wall Street()