Its been almost a month since my last update on Yahoo! and much has transpired in the interim. The company is in play and Jack Ma explicitly expressed interest while visiting Standford.

Here’s a few takes amid the swirl of rumors and speculation…

Price (The White King) – The price action in the broader market has been insane over the past month and $YHOO has held up much better than media and internet companies in general. That said, if a deal was imminent, the stock price would be higher.

As mentioned in my post from September 8, this is a marathon and so the best strategy is not to buy into strength (more on this below) but to have a strategy and to try to accumulate shares lower over time.

The Media (TheBlack Pawn) – The finance news media is a pawn in this chess match. This is incredibly important to understand. They are being manipulated by guys like Ma and others who are smarter, better informed and loaded.

These real players know that the media is eager for any new information and will print what they are told and so they use this to position themselves and spread propaganda that they believe helps them jockey.

Perfect example is Swisher’s recent post at All Things D where she reports that Ma is “‘perplexed’ about why the US has such restrictive rules against foreign ownership of a consumer business.”

He’s not perplexed. He is angling.

It is critical to filter everything from ‘sources’ or ‘purported’ etc.

Jack Ma (The White Knight) – Jack Ma is a man among boys. He thinks strategically, identifies the vulnerable (in this case the $YHOO BOD and Bartz before she left) and then plots accordingly with long term objective all the while exploiting the media. He’s a fricking artist. Watch what he does and says but even more importantly, watch what he does and does not say.

The Rooks (Microsoft and Disney) – These guys do not have a great plan. They have needs.

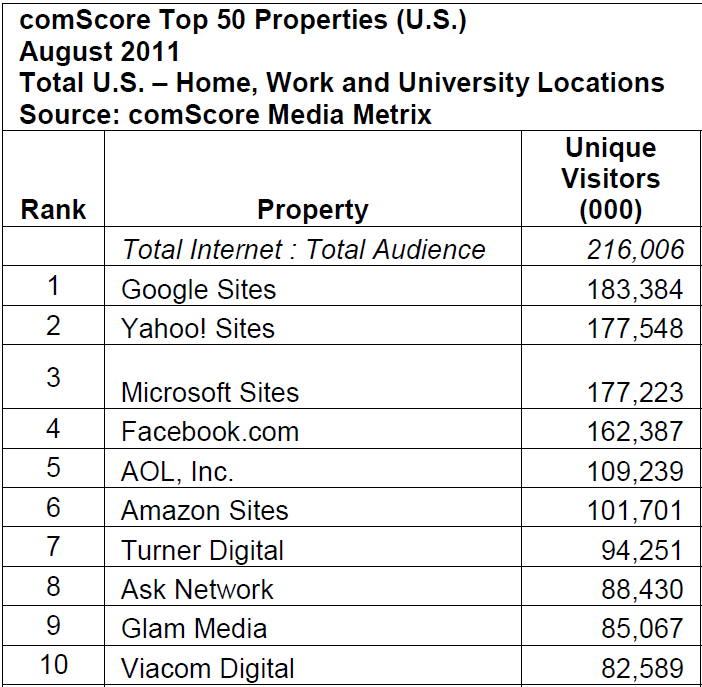

Time (The Black Knight) – $YHOO is fundamentally deteriorating without proper leadership in a hyper competitive environment. While traffic is somewhat inelastic, the sooner they get a deal done the better and if this stretches out too long it will negatively affect the condition and value of their assets.

The Yahoo Board (The White Pawn) – The $YHOO BOD has finally thrown in the towel 3 years after rebuffing Ballmer and $MSFT. They can only save any semblance of face by at least helping to orchestrate some type of deal at a premium to present value. It appears that they do recognize the urgency.

Searching for Bobby Fischer – I see many chasing the stock on news reports and while someone will eventually get lucky there, I believe this is classic noise trading and the real players are trading around those who are buying higher.

The way to play this in my opinion is to recognize risk, that there are many much better informed than you and to try to accumulate shares lower through selling premium and buying lower during downside volatility. I outlined this in my previous post from September 8.

$MSFT $DIS

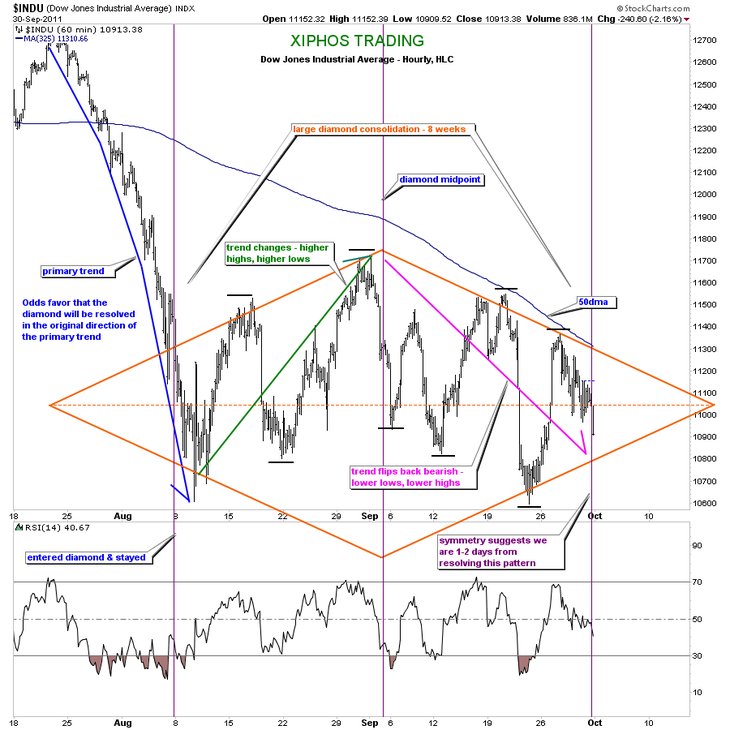

At the end of the day, no one knows where the market is going before it gets there.

At the end of the day, no one knows where the market is going before it gets there.