The weekend is a great time to back up the lens and take a long term view of the charts we examine so microscopically while the casino is open for business.

The following is a collection of weekly and monthly studies from Chartly which do just that.

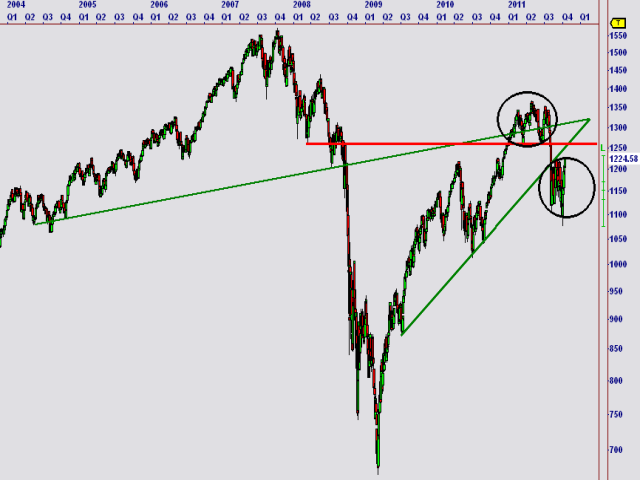

First up, an SP500 monthly via @LuckyElmo21. The Fake out higher, fake out lower looks like we’ll get consolidation in a narrowing range to me…

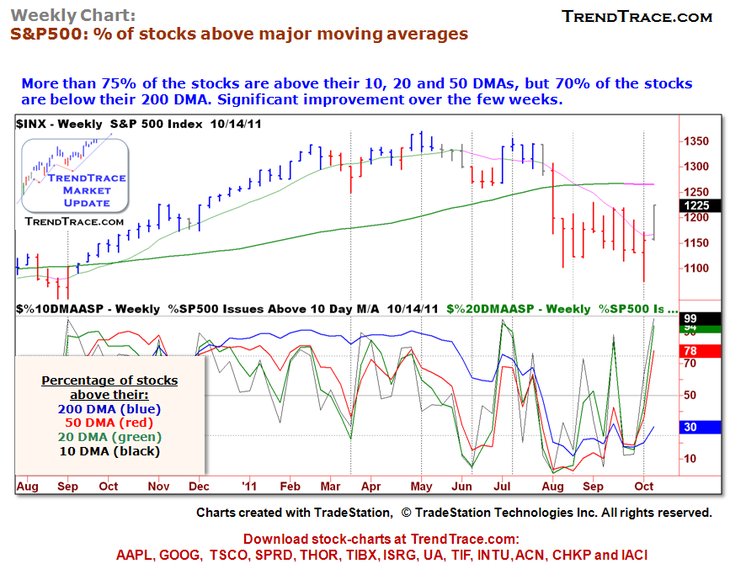

@TrendTrace highlights the big ramp this past week in SP500 stocks trading above their 10, 20 and 50 day moving averages but not the 200. Nice one TT:

Next, @traderyork details this sweet looking Sugar ($SGG) weekly:

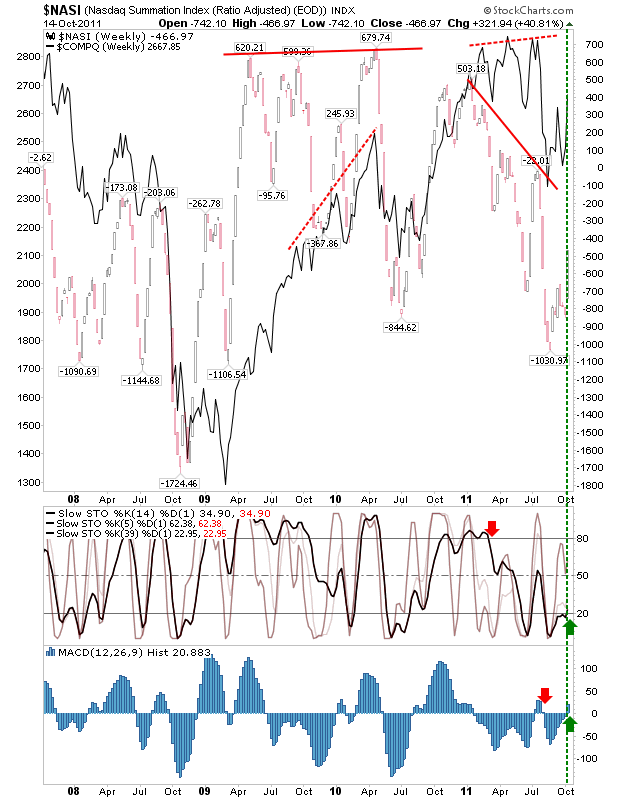

@fallondpicks (who is a great follow btw especially if you are interested in market internals) chalks up the weekly NASDAQ Summation showing that breadth improved dramatically this week. The Summation Index is actually a breadth oscillator and you can find more on it here if interested.

And now for some individual tech names…

@TSD_Trader spots a potential inverse head and shoulders on the $INTC monthly. Great find TSD:

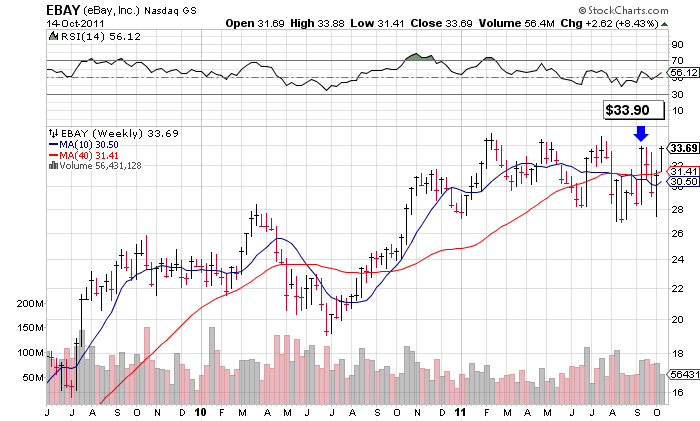

Pro @Kenshreve notes a nice long term setup in $EBAY beofre they report on Wednesday

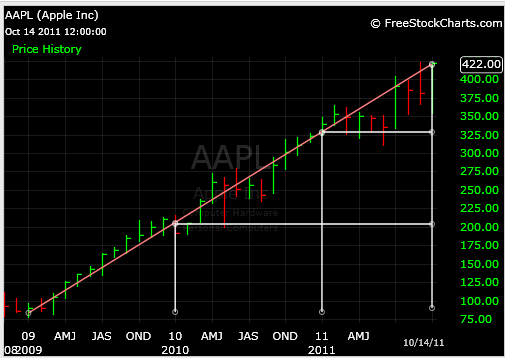

And finally @Stumptowners with the sublime monthly of a littl company you might have heard of. Thanks Stump:

$AAPL $QQQ $EBAY $SGG $SPY $INTC