Today marks John Coltrane’s 85th birthday and the beginning of Autumn which is not a coincidence but more a poetry of timing and space. As if Demeter herself had somehow had a hand in the exultant nature of his work.

8 Fat Swine, 12 Fat Sheep, 2 Hogsheads of Wine…

Today marks John Coltrane’s 85th birthday and the beginning of Autumn which is not a coincidence but more a poetry of timing and space. As if Demeter herself had somehow had a hand in the exultant nature of his work.

Been watching this one chart fo the S&P 500 for a month since Peter’s series of posts in early August.

I’ve drawn 2 lines on it and that’s it.

Its still early but it does look like this morning offers resolution here.

$SPX $SPY

The NYT runs this piece yesterday on the Fall TV line up where the class warfare theme plays a prominent role. About one of them subtly called “Revenge” they write:

And, fittingly enough, “Revenge,” an ABC series starting on Wednesday, is set in the Hamptons. Emily VanCamp plays Emily Thorne, a young woman bent on getting even with the rich family that ruined her father. It’s “Gossip Girl” tailored to this economy, with just enough campy suspense to be enjoyable.

“Revenge” is loosely based on “The Count of Monte Cristo,” and it’s not the only new series that borrows from Alexandre Dumas to skewer the rich. On “Ringer,” a CW show that began this month, Sarah Michelle Gellar plays identical twins, one of whom assumes the identity of the other, like those in “The Man in the Iron Mask.” “Ringer” is even less subtle than “Revenge” in its depiction of the happy few; one early sign that the rich twin, a socialite with a house in the Hamptons, is the evil one is a scene with her in a chignon and an Hermès scarf, willfully steering a speedboat.

No doubt, television producers are playing off the same signals as President Obama as he tries on campaign themes with his “tax the rich” gambit.

Add to this, the feeble attempt at protests which took place over the weekend on Wall Street and what becomes clear here is that the collective American voice lacks the human agency to effectively express and deal with one of its deepest problems, the growing disparity between the haves and the have nots.

I always connect music with the weather. Summer is the southern rock, winter is the Brazilian jazz …

Last night, Autumn most definitely began tumbling in.

Neil Young is all about the Autumn so Live at Massey Hall 1971 goes on the heavy rotation…

Reporters are never the story and when they try to be I call bullshit.

I say this in light of the Mike, Paul and Erik idiocy over the past week.

Hey fellas, write me a story about Yahoo getting sniffed by PE firms or Kvetchr, the latest socnet for yentas, but please spare me the details of your pansy saga.

What are you, Lindsey Lohan?

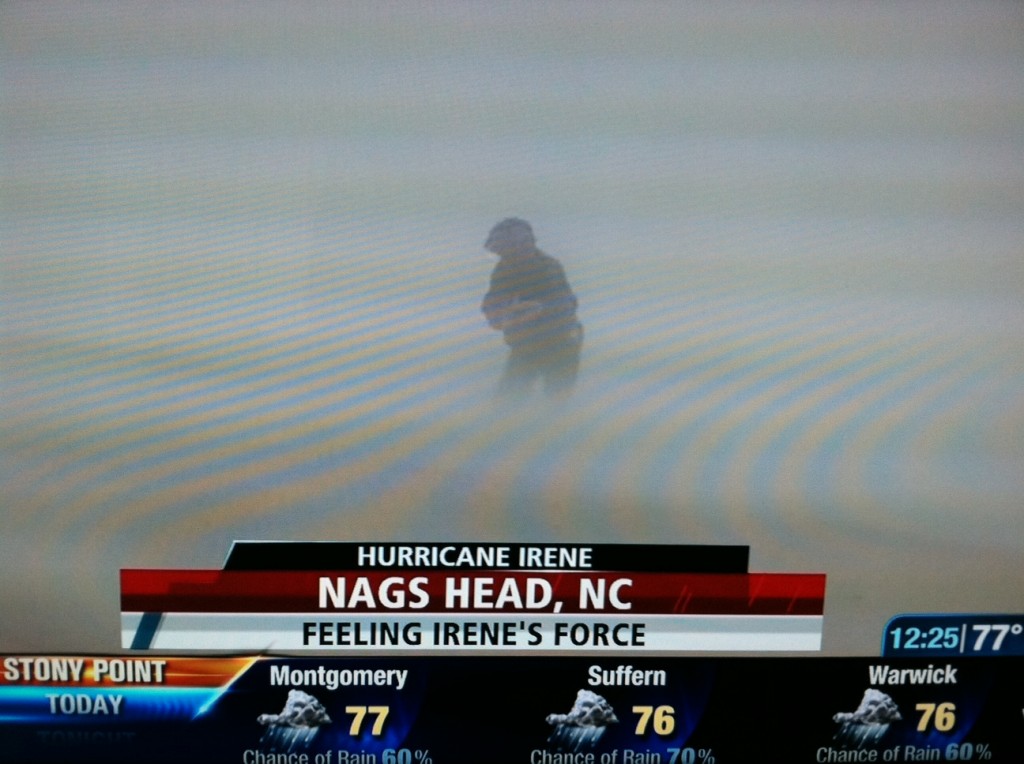

Here is a picture of some guy from the Weather Channel reporting from Nagshead:

Putzilla, go inside. You are not saving anyone’s life. You are not a part of the story, the devastation or one of those losing your house or life.

And hey TechCrunch guys, did you just get a prostate exam because I would love to see the pictures. Maybe you can get Kara to post them and link back and then the NYT can run the story 2 weeks later with a headline thats funny because it misses the gist entirely.

And then maybe one day they will make a movie about the exam and they’ll get Willem Dafoe to play your friggin’ prostate.

Its easy for people to give good advice on how to live and invest but much harder to take it to heart.

Its easy for people to give good advice on how to live and invest but much harder to take it to heart.

One critical variable in determining whether people follow and dedicate themselves to wisdom is the authority of the adviser.

This document, which has been making the rounds, was written by Ray Dalio. For those of you who might not be familair, Dalio is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in history.

If you are looking for guidance on how to approach life and markets, there are very few with more bona fide credentials to give it.

What’s more, this is a holistic approach and an inspired read.

Find it here.

Hattip to @tradefast for pointing this out to me.

It feels good to get your ideas out in the world, leave a little of your imprint around. I have never lost anything by giving ideas away. If people find it useful, it makes me feel good.

– Gerald Appel

The above quote was emailed to me by @gtlackey who said it made him think of StockTwits and he hit the nail on the head..

Appel is the author of Technical Analysis: Power Tools For Active Investors. I have not yet read it myself but Lackey, who is a master technician and a must follow on StockTwits if you are a chartist, recommends it highly especially if you are interested in the MACD as he is the one who developed this indicator.

Asensio has been shorting stocks for a long time and he’s like a pit bull who locks jaws once he gets his teeth in.

Today, $NFLX is trading down big time pre market and has been falling steadily since July on the initial Starz news and after a truly historic run.

This clip from December is classic Asensio and well worth the watch. While he’s likely still down in the trade, no doubt he’s smelling the blood…

By the way, Asensio has a great book from back in the day called Sold Short that you will enjoy.

ht: Zortrades

Amazing to me that the recently released Census Bureau report entitled Income, Poverty and Health Coverage: 2010 (see below for the Bureau’s power point presentation) has not garnered much more attention. For those with an extended time perspective, the report demands close attention as these trends begin to take shape around higher poverty levels and an increasingly bifurcated wealth dispersion.

Some highlights from the New York Times piece summarizing the report:

– Median household incomes fell last year to levels last seen in 1997.

– Americans living below the poverty line last year, 15.1 percent, was the highest level since 1993.

– Median household income for the bottom tenth of the income spectrum fell by 12 percent from a peak in 1999, while the top 90th percentile dropped by just 1.5 percent.

– Blacks experienced the highest poverty rate, at 27 percent, up from 25 percent in 2009.

– Last year, about 48 million people ages 18 to 64 did not work even one week out of the year, up from 45 million in 2009

I could go on and on with the ugly data but you can read the full article here.

I am thinking about this from a top down perspective and what these metrics could look like 3-5 years out with particular focus on what they might portend socioculturally as well as for the market.

One hypothesis is that the income and poverty profile is in a secular trend in which household wealth and standard of living continues to decrease dramatically over time for the middle and lower classes. Such a disparity will come to a head at some point (not close yet) as class based tension and conflict increases over time.

From an investment point of view, I am open to ideas in the comments regarding 2-5 year opportunities.

Its a good thing that Amazon ($AMZN) customers do not have to pay sales tax. How else would the etailer possibly keep up with the likes of Best Buy ($BBY) who continues to crush the ball like Roy Hobbs.

Just look at the numbers.

This morning, $BBY raised per share earnings guidance and will benefit from a 1.5 billion dollar buyback which will add up to a quarter to per share earnings! And if they are buying their own stock, there must be great value.

In addition, Best Buy CEO Brian Dunn had this to say on the conference call:

Best Buy is well positioned to bring the benefits of our multichannel model to our customers and shareholders…

So what’s not to like?

Meanwhile, Amazon is left with scraps and managing to stay afloat with paltry projected year over year revenue growth of 33% for all of 2012. What a mess.

Bezos & company are not only fulfilling their obligation to shareholders by aggressively fighting the payment of sales tax by out of state online retail customers, they are just trying to survive.