Dear Abercrombie,

If you do not want the situation guy to wear your clothes, do not pay him.

Instead, stop making clothes for douchebags.

Cheers,

Phil

($ANF)

8 Fat Swine, 12 Fat Sheep, 2 Hogsheads of Wine…

Dear Abercrombie,

If you do not want the situation guy to wear your clothes, do not pay him.

Instead, stop making clothes for douchebags.

Cheers,

Phil

($ANF)

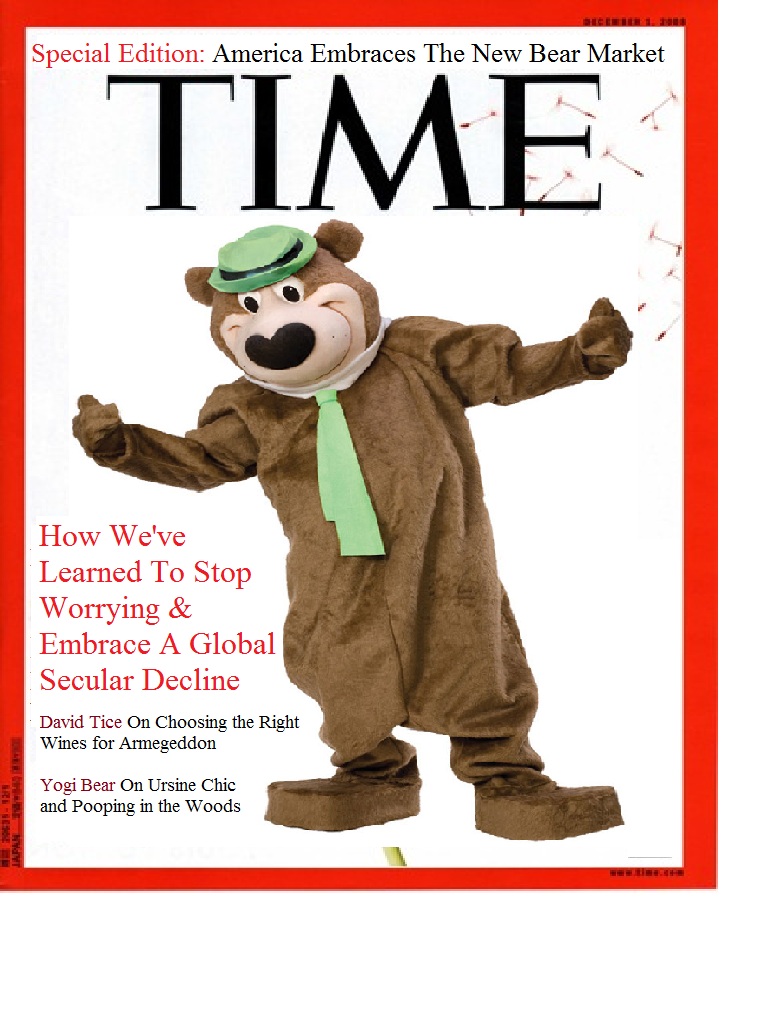

While researching the Magazine Cover Effect, I came across this one from the October 20, 2008 New Yorker.

It is a classic and captures the worst fears at the time complete with not only historical allusions of the stock market in America but to the death of Wall Street and of those clutching and beholden to it.

It was created by famed portrait artist Robert Risko, a protege of Warhol, who has produced countless covers for Vanity Fair, The New Yorker and Rolling Stone.

The $SPX closed that day at 985 but didn’t bottom for another 5 months in March of 2009 more than 25% lower.

To me, the significance of pointing this cover out and the timing of it goes further than just the myths we’ve create due to the biases our imperfect and emotionally shaded memories construct.

It carries over to other less striking but similarly mistaken cues.

If you notice a magazine cover or a mall kiosk offering to buy your gold or the last bull on Wall Street gone cataclysmically bearish on the CNBC, it is nothing more than a reflection of the times and certainly not a sign post of an impending inflection.

($SPY)

During 4 of the trading days last week, we saw wild and disjointed swings in the indices over short periods of time. While some traders were able to exploit the environment, many got chopped around pretty good. The instability subsided last Friday and also yesterday we saw relatively orderly action.

To me, these large swings in either direction over short periods are symptomatic of sentiment instability and make for a difficult trading environment for those who have made their trading plans to suit more normal trading conditions.

With the AM sell off and news coming out of Europe this morning and throughout the day, I am keeping a close eye on the index ETF’s ($SPY $QQQ $IWM especially) and for price indicating the return of such mood swings. So far the action has remained orderly (as of 10:20am et)

I am looking out for signs of a return of the wide swings over short periods of time (ex: 1% or greater in a 5 minute candle), which would signal a return to an unstable sentiment environment over the near term.

The awareness of being in one or the other environment (stable or unstable) can then guide risk management.

As many have already pointed out, the markets have experienced unprecedented oscillating volatility this week with 4 consecutive 400 point days (2 down, 2 up)in the $DIA accompanied by extreme breadth (2 90% up, 2 90% down).

My expectation is that on this Summer Friday, we’ll see relatively muted action with the intraday range less than half of the average of the previous 4 sessions.

It is a matter of pace and rhythm really. A sprinter can only sprint for so long before he must rest a bit.

So we will likely get a respite day and volume will dry up as the day progresses and on the surface, things will look less abnormal.

Sure, take a few deep breathes, relax a bit and enjoy a well deserved Corona con lima this evening.

But don’t let the apparent return to normalcy and a bit of well earned benign complacency bleed over into next week because we’ll likely get more big swings…

$SPY

@MattKelmon thinks we made a bottom on the $SPY Tuesday afternoon:

I am curious how many agree or if most believe we are going lower. Please take this quick poll:

Some notes as I check in on the markets from the beach for the first time since Friday afternoon which might seem to some like an eternity ago.

1. Of course Gold is a currency. Not only is it a currency, but we’ve been using it for coins since at least 700 B.C. Here is a gold coin from Alexander the Great:

I didn’t weigh in on it this at the time Ben Bernanke and Ron Paul had their exchange but it still warrants comment. Either Bernanke responded the way he did for political reasons or because he has no sense of the central role gold has played in the history of money.

Of course, the response was political which serves as a perfect example of how deeply politics has distorted our federal decision making process.

2. Speaking of gold, it looks like I may finally lose my $GLD shares which I have been holding for a very long time. While in the 150s, I wrote the Aug 164 covered calls for a buck and change. I have written near dated covered calls on this position at least 20 times during the hold whenever it became extended shorter term.

This is ok with me if I lose the position as it has been a great run and I can live with missing what might be blow a off in the making. I may try to roll the options forward but this will depend on price late next week. I also might look to write puts to reenter the next time gold gets crushed and at some point it will, no hurry.

3. I’m getting spam emails from brokers with dire warnings and stale parables regarding how a broker should be prepared for these times before hand complete with pitch for funds. Ugh.

4. Huge rallies in this environment are not healthy and when they are accompanied by the collective mood swinging back towards a euphoric denial can be the most treacherous. Recall the 700 point rallies we had into the teeth of the credit crisis.

5. From 10,000 feet, it seems like there is only a small handful of guys out there who have a clear head here and a good plan. Joe Fahmy, Peter Brandt and Upside Joe are among them and there are a few more out there I am not mentioning but not too many.

During these moments, everyone is looking for someone to tell them what to think and do which is an anxiety defense.

6. I’m heading down to the pool to play with the kids. Its been a long time since I have had a break and it comes at a great time.

I wonder what ingredients will be necessary to reawaken the activist spirit in America. We could sure use it.

It seems like we’ve had a secular bull market in apathy since the end of the civil rights movement and Vietnam.

Meanwhile, our government has been broken for a long time and has proven itself incapable of making difficult decisions much less steering us back onto the industrious course we’ve tradionally held as a nation.

So its going to have to be the citizens who catalyze change in the U.S. via activism and protest. We can’t count on our leaders even as we share responsibility for having elected them.

The following are critical factors relating to the emergence of a significant activist movement in the U.S. Please add to the list in the comments below.

1. Further deterioration in the standard of living – We’ve had plenty of bread and plenty of circus and we are fat and tv addled. Disruption in the food abundance we’ve grown accustomed to would spur activism. Persistent high unemployment is moving us in this direction but nowhere near threshold yet.

2. An Event – An event must occur which outrages and/or empowers and which captures the imagination of the people. This will come out of left field and will carry symbolic meaning for the activist movement to rally around.

3. Communication Tools – Social media already exist which can be used to organize a movement and spread information incredibly quickly. We saw it this Spring with the role Twitter and Facebook played in the Middle East uprisings.

4. The Inspiring Leader – A leader must emerge who inspires the people and I’m not talking about a Ron Paul type.

Periods of extreme price volatility have occurred for as long as there have been markets and they will continue to occur periodically as long as humans are involved. Its normal for this to happen from time to time.

The recent environment provides dedicated traders and investors a great opportunity to learn to process and prepare from their own experiences.

We Are All Participant Observers

We are all participants first. During big down swings, we are affected emotionally as I have outlined in previous posts. When you become anxious or panicky, it distorts your decision making capacities and market behaviors (buying and selling). You might become more erratic, over trade or not honor stops.

The key here is that your emotions and your behaviors are intertwined.

Also, we are all observers. While you are caught up in the action with your risk capital at work, you are also acting as an observer. You are analyzing the news and comparing the current period to past events. The key here is what you are attending to and the process you apply. In this case, focus and energy can be placed on your own experience.

Information Processing and Integration

If you take the time to focus on not only the external events but on your own experience during these periods it will pay dividends during the next and inevitable crisis whether it occurs next quarter or five years from now.

If you journal then focus squarely on what these days have been like for you. The more detailed the better. What are you worrying about. What are the thoughts running through your head at this moment and over the course of the past week and the upcoming one. What have you done well and what mistakes have you made. How are you coping and taking care of yourself away from the screens.

Then, you can reread this stuff and annotate as you think of new and important details you might have missed. The more vivid you get the better.

If you do not journal, then now is the time to start with this exercise.

The Gist

The gist is that by introspecting in detail, writing it out, editing and rereading, you will be taking the time to understand how these events are affecting you. You will be processing them and potentially better integrating them with both your internal participant and observer.

Then, the next time around, you will be equipped with a more developed internal schema of your tendencies. You will remember better and the events and your role will be better understood.

You will have a map.

Just a little Friday Fun after a Long and Volatile Week.

HT: @dinosaurtrader for the inspiration

HT: @dinosaurtrader for the inspiration

Back in the day we made a series of absurd StockTwits videos mocking the ascendancy of Nouriel Roubini. This one was funny and now appears quite prophetic…

“Triple dip for you…”