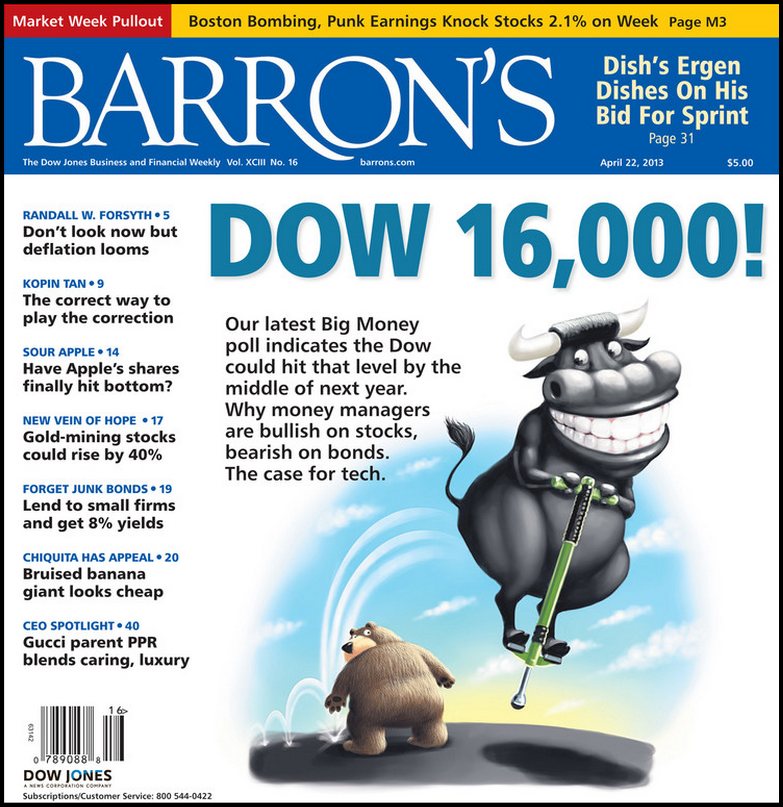

Over the weekend, Barron’s published a bullish cover in conjunction with its Big Money Poll. Here it is (ht: @tradewithmojo):

I was a bit surprised by the timing of it, not because it comes after such a big run in the indices but more from a seasonality perspective as it comes just a week or so before the historically weak portion of the year beginning in May.

While always fun anecdotally, I’m not fully convinced of magazine covers as contrarian indicators, especially the timing (I’ve written about this with some great imagery from the New Yorker). Its often an availability heuristic thing as we seem to remember best instances when things happen rather than when they do not happen.

Regardless, Ryan Detrick posted this older Barron’s cover earlier today from late October 2012 when the Big Money Poll was getting bearish a few weeks before a major bottom:

Again, most salient to me is the neglect for seasonality as equities tend to get strong into November/December.

***

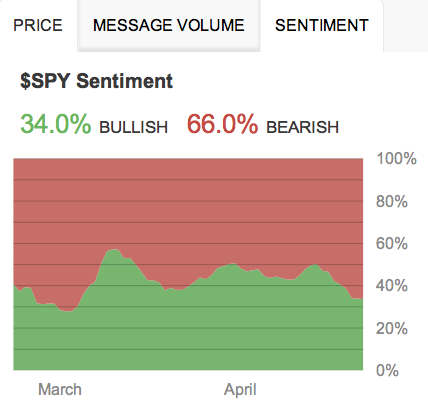

StockTwits has begun visualizing ticker specific crowdsourced sentiment and it is worth noting that this morning social sentiment on the $SPY stream (a proxy for the market that gets lots of votes and so seems a good sample) registered its most bearish reading so far at 66% Bearish vs 34% Bullish.