Don’t love the name but this video is out of hand and more details coming this week:

Read more about this on The Verge: Microsoft IllumiRoom is a coffee table projector designed for the next generation Xbox

$MSFT

8 Fat Swine, 12 Fat Sheep, 2 Hogsheads of Wine…

Don’t love the name but this video is out of hand and more details coming this week:

Read more about this on The Verge: Microsoft IllumiRoom is a coffee table projector designed for the next generation Xbox

$MSFT

Yesterday, I was interviewed by Howard Green at BNN. We talked about the future of Bitcoin and I entertained the notion that large companies will get involved and might create their own currencies.

You can watch it HERE.

We can use the early days of the internet as an analog as large companies rushed in to dominate despite the net’s early non-commercial ethos and only after the internet had proven concept.

Judging by the hate I am getting over this piece I posted yesterday to my blog, you might enjoy

Just did the Google Hangouts with All Star Charts (AKA JC Parets). We wrapped the week that was and talked the SP 500, Singapore & the buoyant bond market. Have a look…

$SPY $EWS $TLT

There must be a small group of geniuses inside the Googleplex who have been observing Bitcoin and thinking deeply about potential implications.

While many of us smirk, myself included, at the illiquidity and the volatility, Bitcoin raises some big and novel issues that might seem obscure at this point:

First, Geopolitical & Macroeconomic – Let’s think for a moment about how invested nations have become in trying to control the value of their own currencies. It has been a race to the bottom for the Yen and at times the Dollar in an effort to spur growth while the Chinese collared the Yuan to keep it from rising. Much of this relates to international trade and so all currencies are intrinsically tied to one another. Even the way we trade currencies are paired, relative to each other.

Further, fundamental currency value is only derived from the faith of the underlying issuer. There is no gold or anything else standard.

Next, Technological – Bitcoin is an experiment. It may fail and I suspect it will but the implication that we are now capable, technologically, of creating an electronic currency not backed by a nation can never be undone. Others, who have learned from the experiment, might create currencies that solve structural and technological shortcomings of Bitcoin. Proof of concept exists and this can not be undone.

(There are also potential sociocultural implications but I will leave a more detailed discussion of this for another day.)

Google does amazing things that at first appear preposterous and that average people mock initially (BTW, Fred Wilson wrote a good piece about this the other day). They’re building driverless cars, experimenting with inexpensive internet services 100x faster than current offerings and building computerized eyewear to name a few.

If Google decided to launch a currency they might resolve 2 of the issues raised above.

On the technology side, there is no one better equipped to fuel and service a global currency created out of whole cloth. Certainly, they would be better prepared than the distributed but faulty network that hinders Bitcoin to this point. Google would also have the second mover advantage which allows them to think through the Bitcoin mistakes and rectify beforehand. Recall, they did this with search coming well after Lycos and Alta Vista and then crushed them.

On the fundamental value side. Google could back the currency with the full faith and credit of, well, Google, a highly profitable company with a 265B$ market cap that already has its own currency in some respects, their publicly traded shares.

Maybe Google partners with a Visa or American Express or a similar established company that has an expertise in transactions and currency.

Maybe they spin the currency out and make it a non-profit…

This has been a thought experiment as we head into the weekend, entertaining the crazy ideas…

$GOOG $V $AXP

All I am hearing about the flash crash is how bad it is and what a threat to the system it is but for the most part, its just overreaction by those who forget market history and the way it has always been.

We have been hearing about the threat since the May 2010 flash crash and for sure, there are serious issues around high frequency trading and social media that require a measured magnifying glass and market participants’ risk management considerations.

I am not making light of it here but the reports are everywhere, overstated and distorted from reality – the scarier the better I suppose.

I don’t see anything here that is as destabilizing or historically out of the ordinary as most reports would have you believe.

Recall the initial response to 09/11 after the first plane hit. Mark Haines was reporting that it was a light plane and neither tower was immediately evacuated.

Over 100 years ago, JP Morgan manipulated US markets more with his pinky finger than HFT or Twitter hackers ever have.

The market is not broken and if it is, then it has always been broken.

Yesterday, Marketwatch quoted me,

In a way, that’s a really healthy thing: The dissemination that it was a hoax went out just as quickly, and the latency was very, very brief… People are not focusing on the resiliency of the market and the self-corrective aspects of social media.

No one is focusing on this – that the market snapped right back as reports were refuted and that refutation spread just as quickly as the false rumor did.

Markets have always been imperfect and manipulated and as long as humans are involved, whether or not they are wielding super fast computers or malicious password cracking software, they always will be.

That’s the playing field so if you are managing risk then plan accordingly.

Over the weekend, Barron’s published a bullish cover in conjunction with its Big Money Poll. Here it is (ht: @tradewithmojo):

I was a bit surprised by the timing of it, not because it comes after such a big run in the indices but more from a seasonality perspective as it comes just a week or so before the historically weak portion of the year beginning in May.

While always fun anecdotally, I’m not fully convinced of magazine covers as contrarian indicators, especially the timing (I’ve written about this with some great imagery from the New Yorker). Its often an availability heuristic thing as we seem to remember best instances when things happen rather than when they do not happen.

Regardless, Ryan Detrick posted this older Barron’s cover earlier today from late October 2012 when the Big Money Poll was getting bearish a few weeks before a major bottom:

Again, most salient to me is the neglect for seasonality as equities tend to get strong into November/December.

***

StockTwits has begun visualizing ticker specific crowdsourced sentiment and it is worth noting that this morning social sentiment on the $SPY stream (a proxy for the market that gets lots of votes and so seems a good sample) registered its most bearish reading so far at 66% Bearish vs 34% Bullish.

Getting into a nice flow talking stocks Friday afternoon with JC Parets. Its a great little wrap.

This week we chewed on:

1. The big $SPX 1538 level

2. Weak Commodities $KOL, $XME et al…

3. Treasuries

Take a look:

Its so very nice when all your indicators line up perfectly.

It would be splendid if the market was showing signs of topping while sentiment was super bullish. Many times, though, we face discrepancies and the markets are not so obliging.

Here’s @wisedom’s chart from this morning that nicely shows, technically, where we are if the market is indeed in the process of topping.

I have been and remain in waiting for the correction mode (see my post Waiting for Godot) so I’m relieved to finally see it looking as if one is shaping up.

It has not been comfortable as the $SPX made all time highs and looked as if it would test or maybe even blow through 1600 sooner rather than later but now the scenario suggests topping and seasonals are also becoming more favorable as sell in May approaches.

So great, commodities are breaking down too and it looks like we will get some fat weekly bearish candles in the major indices come Friday and maybe more damage before traders shift into looking for a bottom mode.

However, I have also been focusing ad nauseam on the very high level of bearish sentiment reactivity and how bullish this has been and potentially remains. What I mean here is that every time the market sinks even a bit, everyone gets very negative very quickly and these episodes look and respond like a bearish sentiment extreme or capitulation that is bullish stocks.

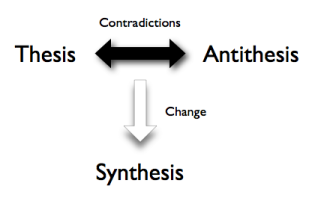

So I am left with apparently opposing signals that are key to how I formulate my market thesis:

1. Price behavior suggesting a corrective process.

2. Sentiment suggesting even shallow dips will be bought.

Rather than interpreting the mixed signals dichotomously, I am taking a dialectic path and attempting to resolve at least to some degree.

The key element for me in synthesis is just sitting with the mixed signals, waiting and watching the events play out with all the imperfections no matter how uncomfortable it might be at times. Its just the gray reality at this moment.

Patience.

One last point – it looks to me as if a lot of traders are anticipating the $SPX top in general and the head and shoulders pattern in particular and I recall prior incidences in which very highly anticipated h&s patterns gave false signals and the market continued to rip.

$SPY $QQQ $XLE