What are we doing here, that is the question. And we are blessed in this, that we happen to know the answer. Yes, in the immense confusion one thing alone is clear. We are waiting for Godot to come — ” – Samual Beckett

Few corrections have been more highly anticipated than the one we are all awaiting here. My great uncle Chuchum even asked me about it the other night at Sedar, “Boychkl, vooch with this correction?”

Few corrections have been more highly anticipated than the one we are all awaiting here. My great uncle Chuchum even asked me about it the other night at Sedar, “Boychkl, vooch with this correction?”

With so many so eager, no wonder it never gets here. Its like the watched pot or, to get more existential on you, Beckett’s Vladimir & Estragon waiting for Godot.

Well, if recent history is any guide, we’ll get it in q2 which begins with the opening bell on Monday morning. That’s a 65 trading day window and an eternity for many traders with a shorter time perspective, but if you are longer term oriented then you can afford to be patient and employ time to your advantage.

My view has been that we are in a bull market as a direct study of price behavior indicates. The $SPX is up 135% from the 2009 lows. That’s a bull.

Equities have been fueled by an astonishing percentage of money out of the market and in money market and treasury funds. As I blogged in September, making a bullish case on the report that Fidelity’s bond and money market assets comprised more than half of the company’s 1.6 Trillion in managed assets:

Let’s think about this for a sec. The public hates the market so much that for the first time ever Fidelity has less of its AUM in equities than in bond and money market funds.

Furthermore, no one is talking about the epic level of dry powder this data point implies.

Despite 2012′s 15% $SPX rally, capital loss remains the primary emotional motivator of the investing public now.

Such an aversion does not get worked off overnight, or in a month, or in the 6 months since these numbers were reported.

Nevertheless, bull markets correct periodically and so will the current one and there is a rhythm.

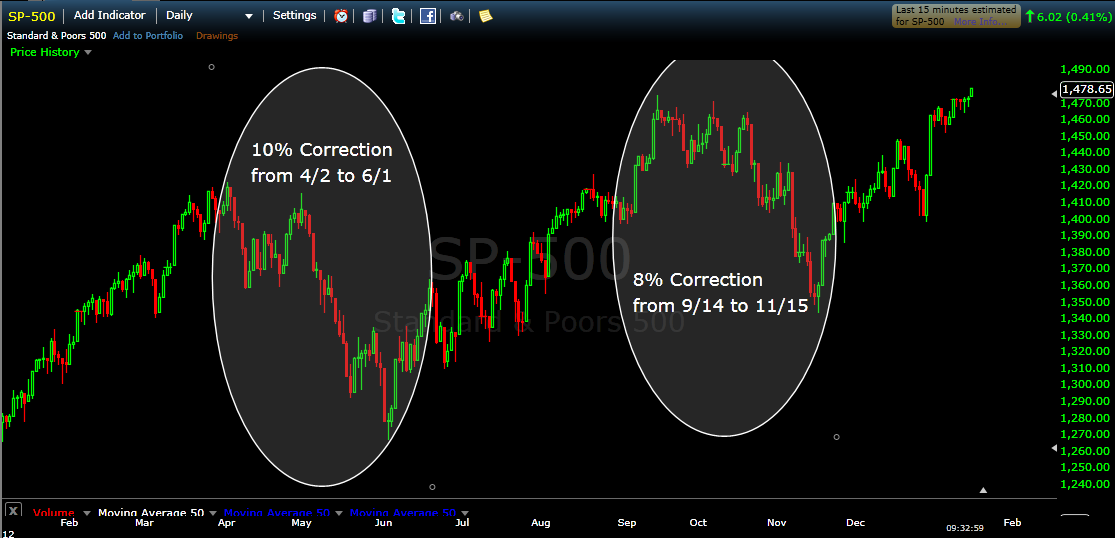

Let’s use 2012 as an analog.

For Q1 2012, the $SPX was up 12% without a 5% pull back. For Q1 2013, the $SPX is up 10% without a 5% pull back. So far, a similar script. For the full year 2012, the $SPX did correct twice, once during Q2 for 10% and then again into Q4 for 8%. Rhythm.

I expect the similarities between 2012 and 2013 to continue and that we will have a pair of corrections within the context of a bull market fueled by persistent loss eversion.

I have been gradually lightening positions since February expiration and so I am underinvested here and getting more so. I will be looking to scale back in when the market gets pummeled.

I risk missing a bull that never corrects. I’m good with that and for now I’m just waiting…