Everyday, I talk with financial bloggers at various stages of development. I get to know them, what they are working on, what motivates them and how they perceive the environment and their roles within it.

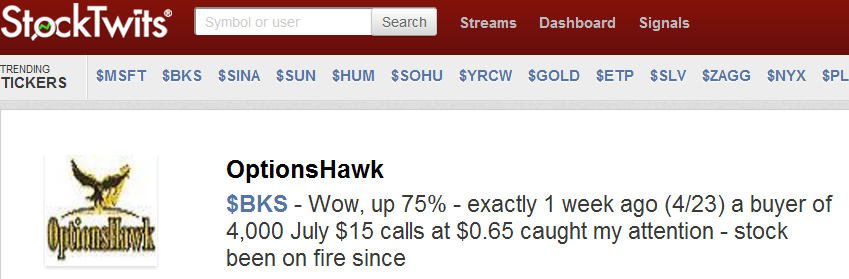

Some of the bloggers I will work with more formally as they join the StockTwits Blog Network but many times we simply connect, chat and devlop a dialog.

Its a great part of my gig and not only have I built relationships with people I respect immensely but also I learn a lot about how to blog, share best ideas and build a great brand.

Over the next couple weeks, I will offer some observations and advice for financial bloggers who want to do it right.

The place to start is here: You Are Your Brand

Technology has spurred a major shift since before the launch of Blogger in 1999. Web based publishing tools have made it incredibly easy for an individual with great ideas and dedication to reach others across the globe who are interested and to grow an audience.

Back in 2009, I wrote the following:

People can now take the effort to craft their identity and evolve it over time through the expression of their ideas. What’s more we can do this in a global public space in which others might respond with their own ideas ensuing a dialog which has the potential to inform, inspire, provoke and ultimately foster knowledge and relationships…

…The upshot is that thinkers across an endless variety of subjects who engage might arise and initiate new knowledge systems which are meritocratic.

Along the way, leaders will emerge who have been vetted more purely than ever before.

We are a witness to and a part of a constructivist revolution in which individuals now have the power to define themselves with their best thoughts.

I stand by that assessment and while it is 3 years later, I think we are still very early in this secular shift in the media landscape from institutional journalism towards individual journalism.

Recently, Josh Brown was interviewed by Forbes and he sums it up very nicely in terms of how this shift affects financial journalism and the individual. (The riff begins at the 6:45 mark and its good).

There are a number of steps you can take in order to bring yourself to the foreground and accentuate You as your brand. Here are a few of the basics:

1. Define Yourself – Self definition and discovery are continuous processes. Still, You will want to clarify some things clearly before you get going which You will no doubt revisit later on.

What are your goals for the site?

Who do you want to reach?

What is it you are most knowledgable about and what types of things do you want to communicate?

What would you like to achieve?

These can change over time and they will but having some idea and specifying them will help you create a site that is congruent with your definition and goals. You will then want the format and style of your blog to follow the function and purpose you have delineated.

2. Make Your Web Presence a Blog First – If the landing page to your site is static, people might visit once but they will not return frequently and they will never be engaged. But, if you update your home page frequently with new and great ideas, then people will come back and get to know who you are and how you view markets and the world.

3. Begin with a Very Simple Site – It is said that to play rock and roll, all you need is 3 chords and an attitude. The same is true in blogging. You want to begin with a simple site.

I recommend using WordPress but that is by no means mandatory.

You do not need a ton of tabs and pages. Home page (which is the blog), About page and Contact. That’s it. You can always add later. (I will write more on this in the next post).

4. Put your photo and bio on the home page – This is about You. Get out there and define yourself authentically and how you want to and then live up to that definition through your ideas.

Your photo on the home page is key as people recognize the human face above all other images.

5. Write About What You Know and Reveal Something About You – The financial blogosphere loves the long tail. If you are an expert in a very specific area of the markets and you write about it knowledgably, people from all over the globe who share your interests or who want to learn more will find you.

You can also write about outside interests. Kid Dynamite writes about farming and making beer and I love those posts. It allows people to know you better and also will bring about unexpected connections and foster serendipity.

6. Make Mistakes Publicly – Anyone with even a little bit of experience in the market realizes that everyone makes bad trades. When you write about your mistakes, people connect with you more not less. Also, you learn from processing your own errors.

7. Use a Good Comments System – Install Disqus and respond to comments on your blog. They foster relationships. You will learn from your readers and they will keep you honest and humble.

Next up, I will discuss more about the design of the financial blog itself…

Its been more than 30 years since Kahneman & Tversky validated man’s innate propensity to be irrationally loss averse.

Its been more than 30 years since Kahneman & Tversky validated man’s innate propensity to be irrationally loss averse.

By now I am guessing that most of you have read about the

By now I am guessing that most of you have read about the

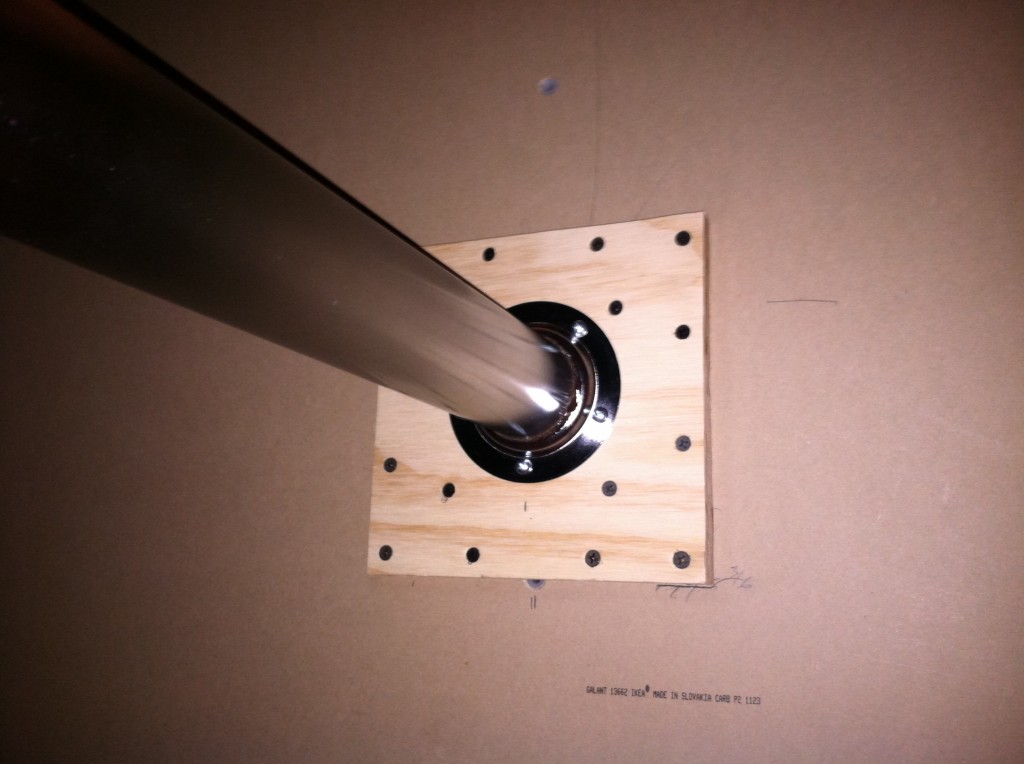

which fits perfectly beneath the table and I am using that for the computer tower and woofer.

which fits perfectly beneath the table and I am using that for the computer tower and woofer.