People use StockTwits in different ways. People share trades, setups and charts, crowdsource breaking news in real time and post valuable news and commentary links.

Some also share process and experiences while trading and investing.

I love this one because the process tweets serve as a log for the trader posting them and for others to observe and learn. What was I going through when this occurred? How did I handle this trade and what was my thinking, feeling and market behavior while this trade or event was afoot.

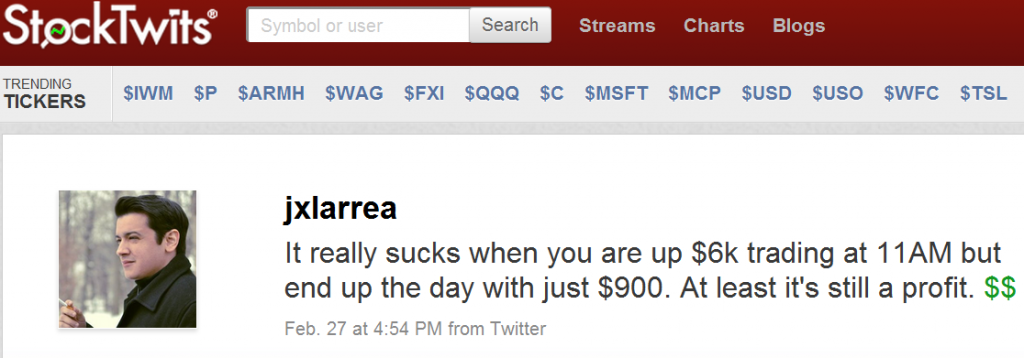

Recently, Xavier Larrea shared a message on the stream that was insightful, generous and honest. He was describing what happened and how he felt being ahead by a lot early in the day and then giving much of it back (all in 140 characters or less!).

It went like this:

@jxlarrea is expressing regret over giving back the majority of his nice early gains over the course of the day. This has happened to everyone. His logging it is honest, universal, valuable to introspection and potentially valuable to others on the stream who see this and have experienced similar give backs.

Think of the difference in experience from someone else who is losing in the morning and finishes the day +900$.

Same outcome, very different experience.

How this frustrating emotional experience might affect traders is very different and based on individual differences in coping with the myriad of stressors involved with trading.

Some are harder on themselves than others. Some brush it off and move on while others ruminate and bring the baggage with them into the next trading day. So the adaptive coping strategies I provide below are not about how to not feel regret as much as preparing for the situation and having a plan.

Setting Portfolio Stops for Short Term Traders

Poets muse that feelings come first while reason and behavior follow.

This is sometimes the case but often it is not, especially in instances where we are practicing a craft such as trading that is challenging and where success demands run counter to our reflexes and instinct.

In the case of coping more adaptively with situations in which we are giving up portfolio gains, we must start with trade behavior management. We don’t need to worry so much about getting rid of the frustration and regret experiences and the negative affect accompanying them.

The strategy in this case is to enact trailing stop rules for the portfolio just as we would a single stock trade.

This is especially useful for shorter term traders who take less overnight risk and where there is higher relevency to p/l over shorter time frames.

Before the trading day begins, the trader will need to establish rules based on the situation which suit the size of the account and the average value at risk.

So let’s say I am a trader who, like @jxlarrea, is up 6k early in the day and my average daily p/l is 2k or less. I am suddenly up 3x my average while only 90min into the trading day.

At twice my average p/l, I might enact a trailing stop rule that ends my trading day if and when my p/l falls to or below my average. I will then go hit golf balls or engage in some other constructive activity.

In addition, for every 1k increase in my p/l from there, I will raise my trailing portfolio stop by 1k.

The details of this example are somewhat arbitrary. Traders must judge for themselves where the daily portfolio trailing stop is. Aside from the size of the account and average p/l, one must also factor average account volatility into the equation. As such, this is similar to rationally setting trailing stops on individual trades.

As we gain experience as traders and make the difficult ones explicit so that we are aware of them, we gain an opportunity to define contingencies so that we are prepared for an additional situation set which occurs on occasion and that affects our emotions and performance.

The Portfolio stop is one contingency for one situation set.

The beauty of enacting a strategy here is that as time passes and you learn to more automatically respond to the situation in a planned, adaptive manner, the emotional effects (regret and frustration) should also subside.