As of this weekend, I am no longer long $GLD which was by far my largest position for a long time.

I held this and traded around it for almost 4 years and have been watching the action extremely closely for a long time. The following are some notes that were good for me to write down and that some of you may find helpful.

First Some Details:

– I entered the position over a few months in q4 of 2007 by selling puts, lost half of the shares in Nov of ’09 getting called and reentered by selling puts.

– Including selling covered calls, my cost basis was in the 50s. (more on yield enhancement below)

– I missed the last 18$ of the rally having sold 164 Aug calls for 1.05 after $GLD had rallied significantly and while it was still in the 150s.

– I may look to reenter (see more below).

On Regret of Missing Gains:

I am experiencing some regret as a result of missing the last and extreme part of this rally and wrote about it this weekend in a private log some of which I am sharing in this post. This is something that I deal with and just try to learn from.

By writing out the process, it looks pretty silly of me to have regret given that it was a big trade so I am just going to laugh at myself here and move on.

I have been through this before and already have a template for not letting the regret lead to chasing these daily rips or doing anything else that is ego baed and not rationally based.

I would not have done much differently and so I think the regret is misplaced and based on greed and not on having done something irrational.

The bottom line here is that I created a good strategy and stuck to it over a long period of time and it was successful.

There, I feel less regret already.

Striking but Anecdotal Observations Are Not Reliable:

I recently posted on the illusory nature of the magazine cover effect and over the course of this monster gold rally I have read about and witnessed so many apparent signs of a top that reviewing them might serve to crystallize the point.

– There have been gold kiosks buying your gold in malls for at least 2 years already.

– There have been the “We Buy Gold” commercials on tv for at least 2 years already.

– There have been wildly bullish gold exclamations on StockTwits for at least 2 years already.

– Over a year ago, my plumber came to fix a faucet and was wildly bullish on gold and told me how his heart doctor recommended he put gold shavings in water and drink them for his heart. It was truly absurd. It happened that his appearance did mark an intermediate top but not THE top. Plumbers or dentists or whatever do not necessarily indicate tops although in hindsight we seem to remember it that way.

While the plumber episode may have marked a beautiful short term top, none of these were contrary indicators in the aggregate.

The Largest Gains Come From Holding Winners Over Time

I could find the Livermore quote for you, but youve likely already read it.

You can read more about this in my chapter in The StockTwits Edge where you will find many great examples of experts managing markets well.

In sum, most of my gains lifetime have come from holding a position over a long period of time.

Gregor Macdonald Is The Man:

It was through a series of long conversations and email exchanges with Gregor that I formulated my positions in metals and this was not the first time. We had a great run in coal stocks as well from 2003 and there is no way I would have reached the conclusions I did without his input.

There are few who understand the macro environment the way he does.

Where From Here?

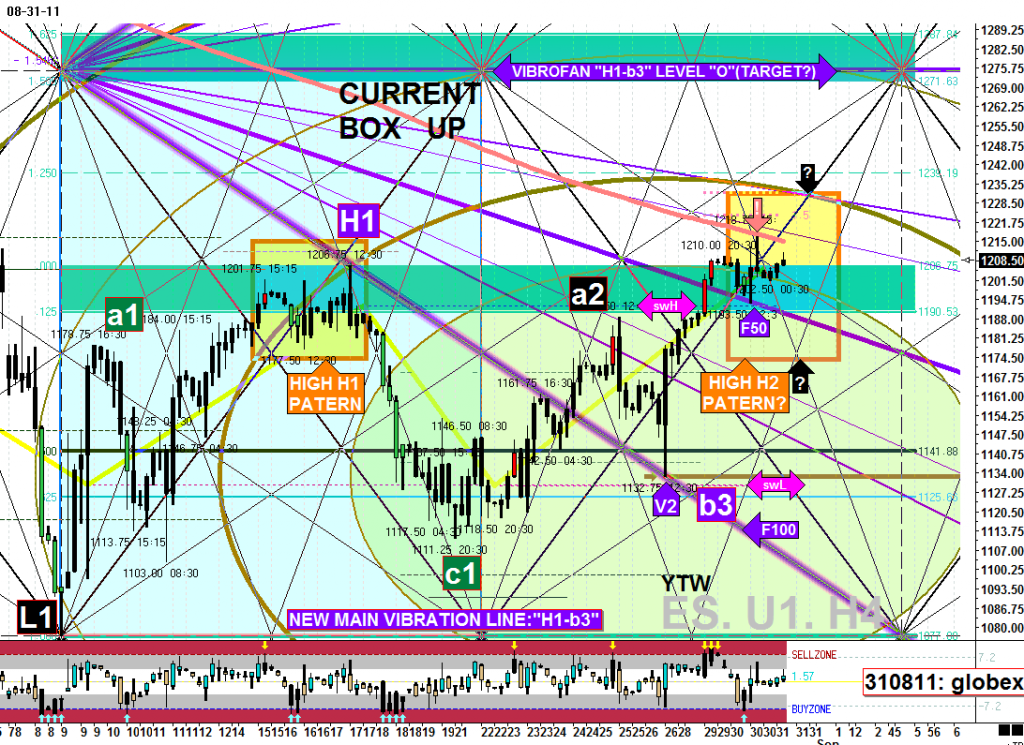

There’s no question that we are seeing a parabolic rise in gold but I am not convinced the long term move is over.

This rationale for the trade was an integration of technicals and global macro based.

The macro part of the thesis posits that there is currently a global and absolute devaluation across currencies occurring and I am not seeing an end to it.

I May or May Not Continue to Trade It

I will continue to look to reenter this position. However, I will be looking for the right setup. Specifically, I will be looking for the price to get hit hard over the course of a couple weeks or even longer.

Presently, we are in a period of high sentiment volatility and there are few assets that are more primitive or more emotionally charged than gold. This will translate into big moves including big sell offs accompanied by many coming out of the woodwork to declare the gold bull over.

I will relay any future actions on StockTwits.

Selling Premium to Enter Positions and to Enhance Yield

I sell near dated premium to enter positions and to enhance yield as a matter of course.

On entering positions, this means that sometimes while earning the premium, I miss the longer term move. I can live with this as I view theta as a chance to have house odds over the market and always know that other opportunities will come along.

In the case of selling calls against the position, I did so qualitatively but consistently on occasions where I observed price get extended and sentiment get super bullish. It was a feel thing.

What I Can Do Better Next Time

The next time I enter a large long term trade I will need to work on managing my call selling better. Regretful or not, I did give up a 10% move and over 30% from a cost basis perspective.

My goal will be to maintain the strategy of only selling calls on portions of the position rather than the whole position which is what I was doing for much of the time I was in this trade.

I think I got too certain of my ability to time the sell offs after big runs and this overconfidence prevented me from better managing the yield enhancement.

Remember the days Greenspan would trumpet productivity improvements brought on by the internet as a key factor in maintaining benign inflation during economic expansion?

Remember the days Greenspan would trumpet productivity improvements brought on by the internet as a key factor in maintaining benign inflation during economic expansion?